Courtesy of Warman-Freed

Source: Courtesy of Warman-Freed

Joanna Mills says there are several promotional measures any retailer can put in place to increase revenue

As community pharmacies come under increasing financial pressure, it is worth giving some thought to how to boost sales of over-the-counter (OTC) medicines and products to increase much-needed revenue.

Investing in an expensive sales and marketing consultant or a fancy advertising agency is a luxury most pharmacies cannot afford —and do not actually need — but there are several simple promotional measures any retailer can put in place to keep tills ringing.

Having a strong identity, and a clear sense of what your business is and why your customers should choose to shop with you, are recipes for commercial success. But how does a pharmacy go about defining and developing this all-important unique personality? The team at Warman-Freed pharmacy, Perrigo’s centre for pharmacy learning in North London, looked at how to create a strong identity when it was rebranded in 2014.

Initial impressions suggested that the London pharmacy had a recognisable local identity but closer analysis revealed the message was not as strong as it could be. Externally, window displays centred on premium beauty, not health, and there were no icons or cues about the pharmacy services available. Inside, the retail layout of OTC products made self-selection difficult and there was no mention of late opening hours. It was evident that some work was needed on the Warman-Freed ‘brand’ to stand a chance of driving OTC sales.

Building a brand

When building a brand identity, many companies focus on the wrong priorities. A brand is not a cool logo, a suite of corporate colours, or a catchy slogan. It is not what a company says about itself. A brand is what customers, staff, suppliers or competitors think when they hear a company name.

Source: Courtesy of Warman-Freed

Warman-Freed pharmacy, Perrigo’s centre for pharmacy learning in North London, was rebranded in 2014

Everything a strong brand says and does reflects what it wants to be and underscores its customers’ sense of what it is. John Lewis and Poundland are good examples of brands that have accomplished this well. John Lewis is renowned for great customer service and quality that offers good value, while everyone knows that Poundland offers products at one low price.

It is no different for community pharmacies. If you are clear and decisive about your identity, customers will come to know exactly what to expect each time they walk through the door, making them more likely to embrace the services on offer and engage with the retail offering.

Asking a few questions can help give you the best chance of success over the counter. What is it that you do well? Where do you want to be in the future? Who are your customers? And finally how do you, or could you, make yourself different to your local competitors? For example, your staff might be renowned for always being willing to go the extra mile. You may, for example, have a long heritage in the area and be an established part of the community. Perhaps you are known for your traditional values, or, at the other end of the spectrum, your high-tech approach. When a conscious decision has been made about what you are striving to achieve, this can provide a firm foundation for decision making.

No brand can be all things to all people so it is important to concentrate on a small number of core qualities and aims. Similarly, truly great brands never compromise on their identity and once you have decided what you stand for, it is crucial that this runs through everything you do. All activities, from staff training to product displays, must reinforce this brand identity.

Finding out as much as you can about the unique requirements of customers in your area is a useful exercise. For example, a colleague had twins at a specialist neonatal ward for premature babies. When he needed to get specialist infant formula, the neighbouring pharmacy offered no supplies for premature babies and therefore had to order products in. The pharmacy owner had failed to see that he had a ready market for a whole range of products that were not on sale in his store.

Choosing the right products for your customers

If your pharmacy brand is concerned with what your customers think and feel about you, the other side of the marketing coin is what you know and understand about your customers. Maintaining identity is essential and a core range will be dictated by your identity. If you provide prescriptions for several schools locally, for example, consider developing the child health category and complementary products. If you have an older demographic locally, consider a range of mobility products.

You also need to consider how to adapt your range in line with shopper needs to remain relevant to customers across the year. For example, during the allergy season (March to September), many supermarkets and larger pharmacy chains will have hay fever products on offer, which can make it difficult to compete on price. Pharmacies should therefore focus on adding value by offering customers sound advice, using their skills to advise customers on what will work for them, rather than just offering the cheapest product. In this instance an important point of difference that sets the pharmacy apart from grocery competitors is immediate access to a healthcare professional.

Source: Courtesy of Warman-Freed

The team at Warman-Freed conducted consumer research and analysed electronic point-of-sales transaction data to identify customer trends linked to purchase behaviour

The team at Warman-Freed pharmacy wanted to gain an understanding of their customers to plan for the arrival of the hay fever season in an attempt to meet sufferers’ needs before, during and after seasonal peaks. They acknowledged that many patients who suffered from mild or moderate hay fever were not selecting the best treatment or prevention because the team had not considered why these patients might visit pharmacy before and during the season.

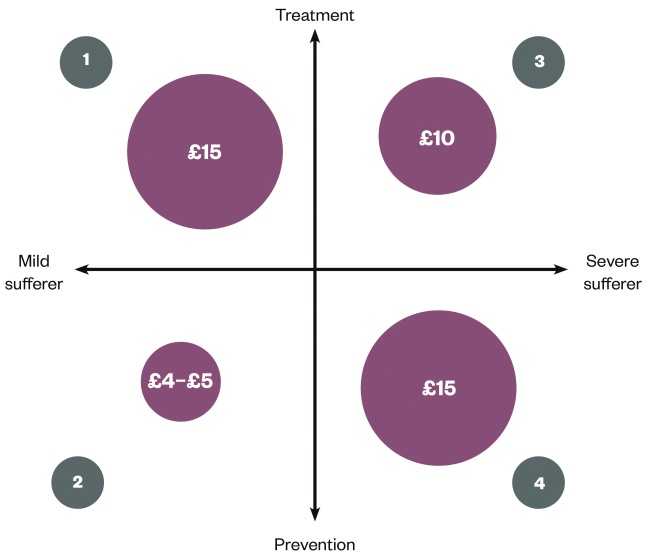

Consumer research and electronic point-of-sales transaction data was analysed to identify customer trends linked to purchase behaviour. The team identified four different types of customers within the allergy category. They then categorised the different customers according to their needs, based on whether their symptoms were mild or severe, and whether the person was preparing for the season or managing their symptoms. The pharmacy team analysed the value of each customer type for the pharmacy per visit so they could tailor their approach to target the biggest opportunities. For Warman-Freed, this turned out to be severe sufferers, who were looking for their preferred product to stock up ahead of the season and then searching for new treatments during the season.

This approach also enabled them to review their product range, introducing new products or streamlining the range where necessary. As a result, the team introduced a bigger range of nasal sprays and nasal irrigation to cater for a more extreme sufferer.

By genuinely understanding customers’ needs rather than simply making assumptions, the pharmacy was in a stronger position to deliver better service and healthcare outcomes.

Figure 1: Delivering better service and healthcare outcomes

Sizing the value of each customer with an estimated average individual spend per transaction

Windows that work

An eye-catching window or in-store display is a great way to attract attention and boost sales. But how does a pharmacy create a display when they have limited time and finances — and perhaps even less artistic talent?

- Make sure the display reflects your brand – it should be appropriate in line with your style of service and the customers you are seeking to attract;

- Focus on one message to create impact and ensure the offer is easy to understand;

- Make use of sales representatives from pharmaceutical companies, who may be happy to provide products and props. However, you should ensure they can fill the whole window or display area to avoid creating mixed messages with too many brands;

- Invest in some simple furniture or other items, such as tables, to create a template that can be adapted to suit different displays, and allocate a small budget to printing;

- Ask other local retailers who may have display materials they are happy to share;

- Plan an annual calendar to make the most of all seasonal opportunities;

- Remember the display should have a measurable impact on sales – it is not just for decoration.

Learning and sharing

Warman-Freed Pharmacy in London’s Golders Green has been serving the healthcare needs of the local community since 1956. In 2014, it also became a centre for pharmacy learning, supported by Omega Pharma. The business continues to operate as a fully functional retail pharmacy, but now has additional capabilities, including a dedicated research team who monitor and track how the pharmacy is used by the local community.

This insight has then been used to improve the business and it is also shared so that other pharmacies can consider applying the lessons to their own pharmacies.

Reading this article counts towards your CPD

You can use the following forms to record your learning and action points from this article from Pharmaceutical Journal Publications.

Your CPD module results are stored against your account here at The Pharmaceutical Journal. You must be registered and logged into the site to do this. To review your module results, go to the ‘My Account’ tab and then ‘My CPD’.

Any training, learning or development activities that you undertake for CPD can also be recorded as evidence as part of your RPS Faculty practice-based portfolio when preparing for Faculty membership. To start your RPS Faculty journey today, access the portfolio and tools at www.rpharms.com/Faculty

If your learning was planned in advance, please click:

If your learning was spontaneous, please click: