NHS Confederation

NHS clinicians will not have to declare their income from private practice following a change of heart by NHS England.

The organisation that leads the NHS in England has dropped its original proposal, put out for consultation in September 2016 as part of its crackdown on potential conflicts of interest in the NHS, which stated that income from private work should be declared.

Instead, the new managing conflicts of interest guidance — which comes into effect in June 2017 — now only expects clinicians to reveal what they practice, where the service is carried out and when.

The guidance says: “These provisions are designed to ensure the existence of private practice is known so that potential conflicts of interest can be managed.”

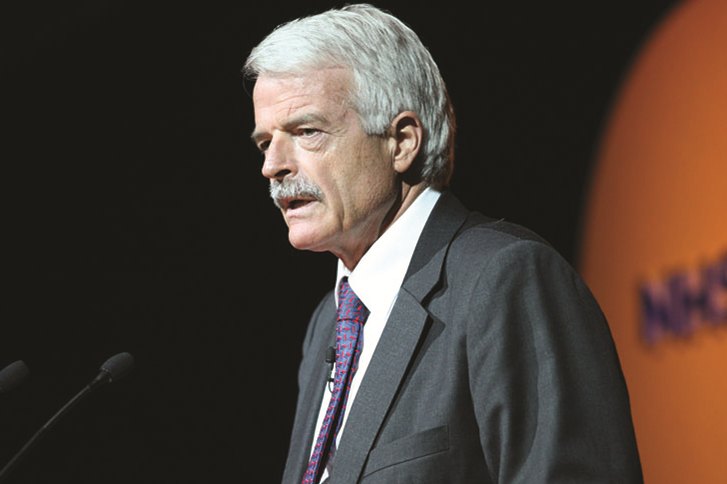

Publishing the new guidance, Sir Malcolm Grant, chair of NHS England, says: “This new guidance will bring a consistent approach to conflicts of interest and ensure that the public can have faith in the integrity of the NHS.”

Under the new guidance, all NHS staff will also have to declare any gifts they receive which are worth more than £50. All gifts from suppliers or contractors should be refused, while low-cost branded promotional aids worth £6 or less can be accepted. Gifts of money or vouchers from patients or families should always be refused.

Hospitality — such as travel, meals or accommodation — should only ever be accepted if there is a legitimate business reason and the hospitality is proportionate. It should never be accepted if there is a chance it will affect professional judgement.

Outside sponsorship of events is also allowed on condition the event would benefit the NHS. Sponsored research is permitted, providing the proper protocols are followed and that processes are transparent.

The guidance does not apply to community pharmacies, the document confirms.

You may also be interested in

Tackling the NHS drug budget: why we set up a regional collaboration for medicines value

Lack of joined-up working between pharmacy and general practice is ‘nonsensical’, says former BMA chair