JL / Shutterstock.com

Community pharmacy is in the throes of a digital revolution. So far, more than half of patients in England have nominated a community pharmacy to dispense their prescriptions using the electronic prescription service (EPS) and nearly two-thirds of items in England are now dispensed in this way.

According to Richard Ashcroft, programme director for digital medicines at NHS Digital, nearly all prescriptions will be dispensed through the EPS within the next 12 months.

He told The Pharmaceutical Journal that the number of prescriptions dispensed through the EPS “will probably never be precisely 100%” but added that NHS Digital’s “aim has always been to get into the ‘mid-90s’ percent” as some patients “may still want a paper prescription or may still need it”.

Although patients can nominate any community pharmacy to dispense their prescriptions through the EPS, a growing number of online apps and websites are coming to the fore, aiming to enlist as many patients as possible — the selling point being that they don’t need to visit a bricks and mortar store.

However, high street multiples are fighting back by launching apps that allow patients to order repeat prescriptions to be delivered to their homes or via Amazon-style collection lockers, meaning patients do not necessarily need to see a pharmacist unless the pharmacist requests a face-to-face conversation.

These digital expansion plans come amid a general trend of industries shifting customer activity online, as well as the NHS agenda to provide “digitally enabled care” across the health service, which was set out in the ‘NHS Long Term Plan’, published in January 2019.

They also come at a time when some of the multiples are facing financial struggles, with LloydsPharmacy having closed or sold off 200 stores owing to “government policy on reimbursement and retrospective clawbacks” in 2017.

Rowlands Pharmacy faces similar challenges and, in February 2019, it announced plans to sell off 70 pharmacies. Also, following news that its profits fell by a fifth in 2018, Boots announced in June 2019 it would close 200 stores over the following 18 months.

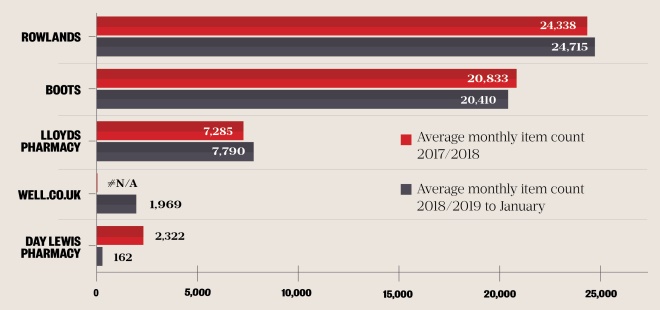

Despite their efforts to boost their digital offerings, most of the biggest high street multiples are still behind the top distance-selling pharmacies in terms of the average number of items dispensed each month.

Average item count of the distance-selling arms of multiple pharmacies

Source: Rich Lee

Calculations using 2018/2019 data to January 2019 from NHS Business Services Authority supplied under an FOI request

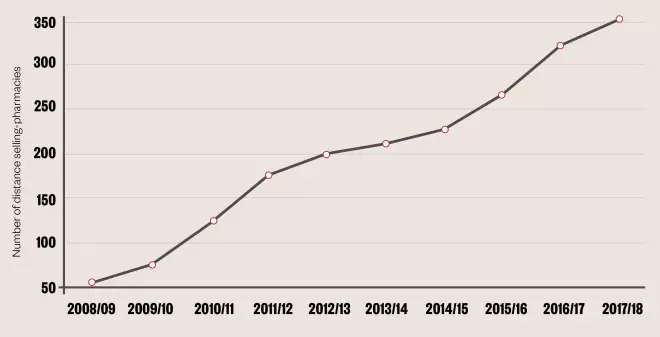

The number of distance-selling pharmacies — which are defined as having either an online-only presence or are registered as the online ‘arm’ of a bricks and mortar pharmacy — is on the up. There were 350 distance-selling pharmacies dispensing in 2017/2018 compared with 56 in 2008/2009,

according to figures from NHS Digital

.

The increase in the number of distance-selling pharmacies since 2008/2009

Source: Rich Lee

NHS Digital, General Pharmaceutical Services

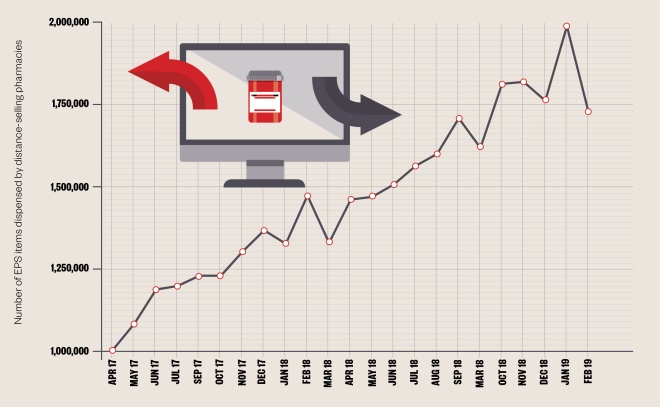

Between 2017/2018 and 2018/2019, the total number of items dispensed by distance-selling pharmacies increased by 23%, from 20.1 million items to an extrapolated figure of 24.7 million items, based on analysis of data by The Pharmaceutical Journal, which was provided by NHS Business Services Authority (BSA) in response to a Freedom of Information request.

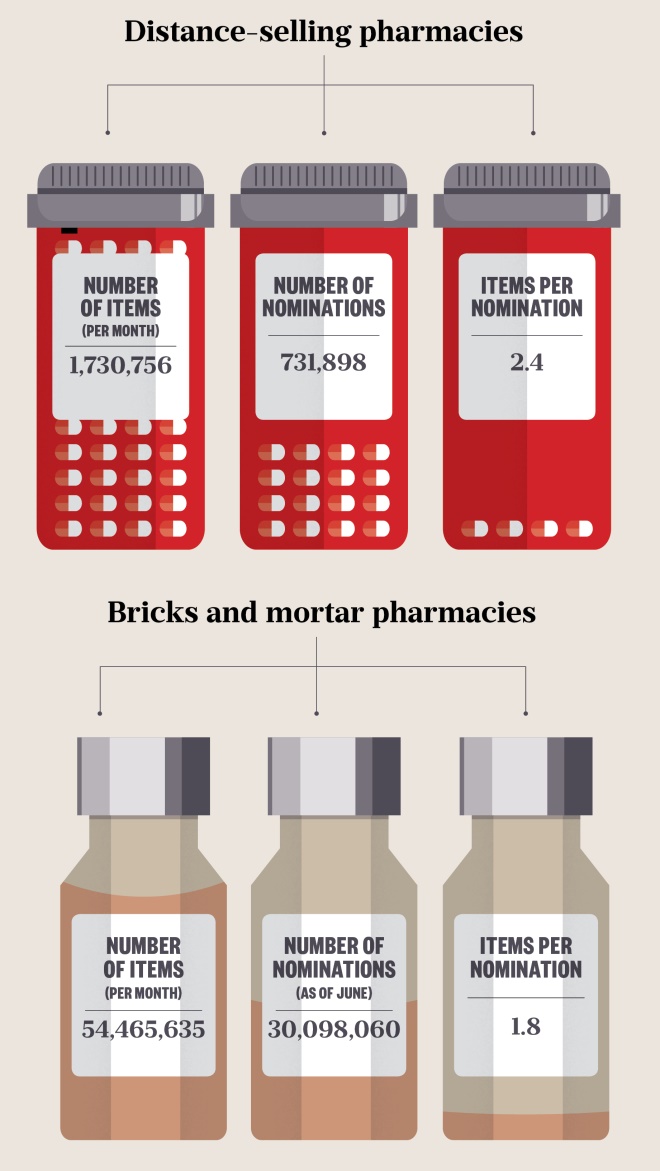

This growth has been partially driven by the EPS,with distance-selling pharmacies dispensing 30% more items for every EPS nomination than non-distance selling pharmacies. Where distance-selling pharmacies are dispensing 2.4 items for every EPS nomination they receive, bricks and mortar pharmacies dispense 1.8 items.

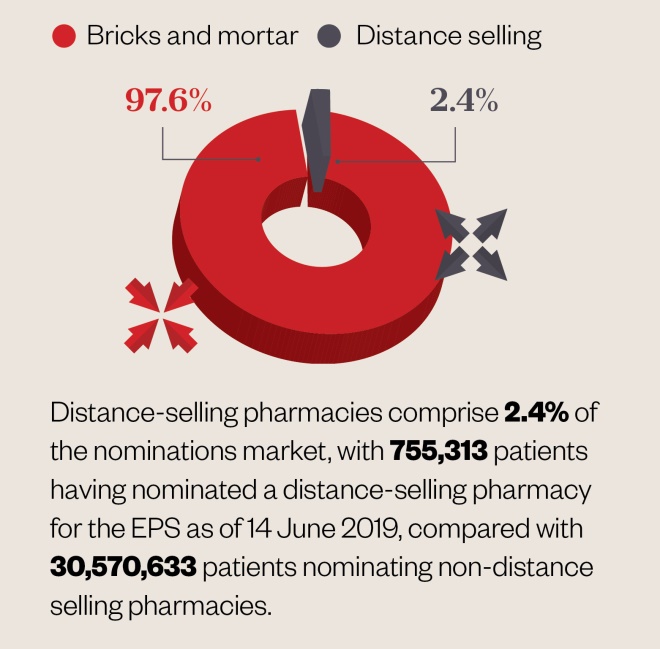

Patient nominations under the EPS scheme

Source: Rich Lee

Distance-selling pharmacies comprise 2.4% of the nominations market, with 755,313 patients having nominated a distance-selling pharmacy for the EPS as of 14 June 2019, compared with 30,570,633 patients nominating non-distance selling pharmacies. Calculations using NHS Digital data as of June 2019. Nominations by dispenser.

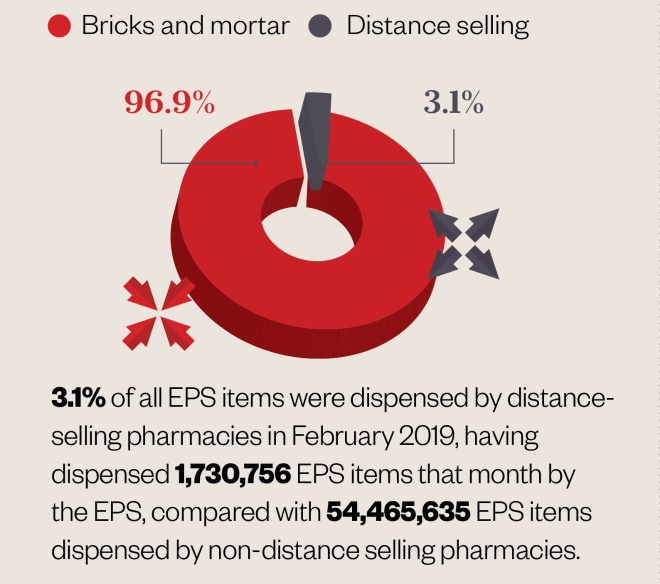

Proportion of items dispensed under the EPS

Source: Rich Lee

3.1% of all EPS items were dispensed by distance-selling pharmacies in February 2019, having dispensed 1,730,756 EPS items that month by the EPS, compared with 54,465,635 EPS items dispensed by non-distance selling pharmacies. Calculations using data from NHS Business Services Authority as of February 2019, pharmacy and appliance contractor dispensing data.

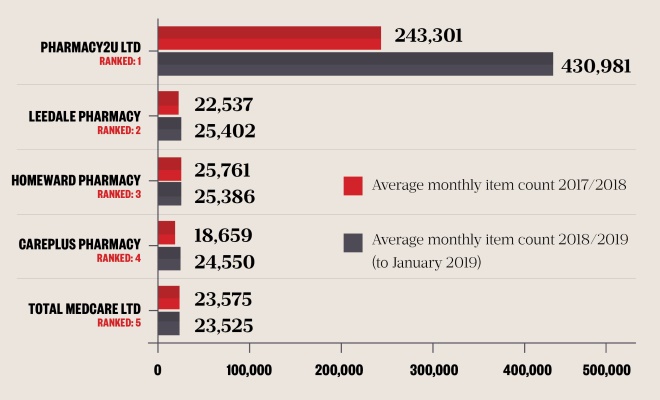

The NHS BSA’s data show that Pharmacy2U has the highest dispensing rate of all distance-selling pharmacies, at an average of 430,981 items per month in 2018/2019 — nearly double its average monthly dispensing rate in 2017/2018 (243,301) and 17 times more than the online pharmacy with the next highest dispensing rate, Leedale Pharmacy, which dispensed 25,402 items per month, on average, in 2018/2019.

The top five distance-selling pharmacies

Source: Rich Lee

Source: Calculations using 2018/2019 data to January 2019 from NHS Business Services Authority supplied under an FOI request

However, England’s largest online-only pharmacy is planning for an even bigger expansion by opening a new dispensing facility in Leicester, which will be six times the size of the facility it currently operates in Leeds.

The new facility, which is due to be fully operational by 2021, will give Pharmacy2U the capacity to dispense a total of 7.5 million items per month, compared with the 1 million items it can dispense from Leeds, and help realise its goal of becoming the definitive market leader in a distance dispensing industry that makes up 10% of the total prescription market.

Online competition

The growth of the online market has made bricks and mortar pharmacies of all sizes take stock.

How the e-prescribing market has grown

Source: Rich Lee

Calculations using data from NHS Business Services Authority, pharmacy and appliance contractor dispensing data.

Numark, a trade membership body for independent pharmacies, told The Pharmaceutical Journal that it has heard anecdotal “evidence of prescription decline” as a result of patients choosing other pharmacy options online.

An increasing number of people are choosing to get their prescription from an online dispensary, which is having a detrimental effect on local pharmacy

In a statement, published on 10 July 2019, Numark said: “An increasing number of people are choosing to get their prescription from an online dispensary, which is having a detrimental effect on local pharmacy, even though online pharmacies offer a very limited overall health service.”

To encourage more patients to return to using their local community pharmacy, Numark launched a poster campaign in July 2019 to highlight the issues with online pharmacies, such as delivery delays, as well as the benefits of a face-to-face visit to a local community pharmacy.

Jeremy Meader, managing director at Numark, said: “Community pharmacy is all about providing patients with an accessible and high quality healthcare service.

“Online pharmacies are unable to provide the same level of personal care and we want to see patients remaining loyal to their local pharmacists who are continuing to provide an excellent service that goes beyond prescriptions.”

Premature concerns?

Nevertheless, the growing concerns over the impact of online pharmacy may be unfounded. An analysis of data from NHS Digital by The Pharmaceutical Journal reveals that patients with EPS nominations for distance-selling pharmacies account for just 2% of all EPS nominations.

As a result, NHS BSA data from February 2019 show distance-selling pharmacies were dispensing just 3% of all items prescribed through the EPS.

Number of items per nomination

Source: Rich Lee

Calculations using data for February 2019 from NHS Business Services Authority; pharmacy and appliance contractor dispensing data; calculations using NHS Digital data for April 2019, nominations by dispenser.

With bricks and mortar pharmacies still the preferred option for most patients, what may be more of a threat to smaller pharmacies, as well as those that operate online only, is the multiples’ ability to offer patients the best of both worlds.

Despite lagging behind the top online dispensers in 2018/2019, two of the four multiples — Boots and LloydsPharmacy — made major company acquisitions in recent months to kickstart their online offering, aiming to boost their patient numbers.

“It’s about how we transform that patient journey so that we attract more patients to come to us,” says Stephen Watkins, director of pharmacy items at Boots, who is also heading up the company’s digital transformation.

In December 2018, Boots bought health technology company Wiggly-Amps, saying at the time that the acquisition would allow patients to order prescriptions online by linking their GP records with the Boots app.

Then, in July 2019, the company opened its flagship store in central London, providing patients with a suite of high-tech options to collect their prescription in-store, including a fast-track lane designed to guarantee that patients will receive their prescription within two minutes, as well as Amazon-style lockers from which patients can collect their medicines ordered via the Boots app by entering an access code.

Best of both

Watkins says his company is “uniquely placed” to offer a combination of both online and in-person care.

“I see a big opportunity to be able to have online growth — because that’s clearly where the market’s moving to,” he says, while also noting the “relatively slow” growth of the online pharmacy market so far.

“What we know is that the majority of our patients are choosing to order online, but also collect in store because they like the care that our colleagues can bring.”

Even though prescriptions can be ordered online, Watkins says having a physical presence means a pharmacist can still discuss medicines with the patient if needed.

“With the lockers, we’ll be able to put a message on the prescription bag telling patients that we need to speak to them if required,” he says, adding that the new system means the pharmacist will also “be able to text the person to say: ‘Rather than the locker, can you come and collect it from the express pick up,’ or: ‘Can you come to speak to the pharmacist?’”.

Although the company announced that it would be closing 200 stores, Watkins is confident that with “90% of the population within ten minutes of a Boots store … nobody else can offer that accessibility as well as a market-leading online offer”.

Chris Ellett, transformation director at Well Pharmacy — which reported in January 2019 that the number of patients signing up to its online NHS prescription service exceeded the company’s target by 3,000— says that while scale and efficiency are important to customers in the online pharmacy sector, “what is really crucial is trust”.

Multiples have no choice but to provide an online pharmacy offering

“The implications of getting medication wrong can be dangerous, so ensuring patient safety and building a level of trust with patients is paramount to everything we do in pharmacy, but even more so as you move into the digital space,” he says, adding that the 780 Well Pharmacy stores are “well placed to lead the way”.

However, Ellett admits that the multiples have no choice but to provide an online pharmacy offering. “If we don’t do it, others will. It’s driven out of pure customer need,” he says.

“There has been a level of tolerance of a substandard service because people understand that the NHS is under pressure and therefore accept gripes, such as longer waiting times [and] the journey from GP to pharmacy.” But, he says, customers now “expect and want more”.

The wave of multiples joining the online market also includes LloydsPharmacy, whose parent company McKesson UK bought repeat prescription app ‘Echo’ in June 2019 to “help people to take more control over how they manage their health online”.

Even former heavyweights in community pharmacy have returned to claim their share of online business, with the Co-operative Group — which sold its pharmacies in 2014 — acquiring Dimec, a healthcare technology start-up that had produced its own repeat prescriptions app in September 2018. The Co-operative Group also launched a locker collection system in May 2019, similar to that of Boots, which will be available through its Health App.

Meanwhile, Rowlands Pharmacy — which announced it was selling 70 of its high street stores in February 2019 with promises of “investing in the future” of automation — is the only ‘big four’ multiple not to have announced a new digital initiative in recent months.

Only a bricks and mortar pharmacy presence in our communities can deliver the personal preventative care patients want and need

Benefits of a face-to-face service

A spokesperson for Rowlands Pharmacy told The Pharmaceutical Journal that online pharmacies and bricks and mortar pharmacies “together deliver maximum benefit to patients and the NHS in a way that a stand-alone online service cannot”.

On the other end of the spectrum, they add that bricks and mortar pharmacies still provide “the biggest benefit to patients and the NHS”.

“Only a bricks and mortar pharmacy presence in our communities can deliver the personal preventative care patients want and need,” they say, adding that pharmacies do “need to offer effective online propositions, but they supplement — not replace — the essential services bricks and mortar pharmacies provide”.

The online pharmacy industry will definitely grow exponentially because that’s what patients are looking for, that convenience

How exactly the balance between bricks and mortar community pharmacy and online pharmacy will be struck is still unclear.

Although Watkins is unable to predict exactly how much online dispensing Boots will do in the next five or ten years, he suggests that it could mirror online banking, which has undergone “a similar type of journey”, where 86% of people now use an app to interact with their bank.

“I think [the online pharmacy industry] will definitely grow exponentially because that’s what patients are looking for, that convenience,” he adds.

Ellett says that trajectory will likely take a decade. “The pharmacy industry is roughly ten years behind that of retail and financial services in terms of digital,” he says. “But the rate of adoption will be much quicker given the availability of technology and the fact that customers are now much more familiar with digital services.

“And with 71% of prescriptions being repeats — a number only set to grow — the opportunity for growth in online pharmacy is huge,” he adds.

Yet with Boots promising a combined physical and digital service “nobody else can do”, Well Pharmacy suggesting it is “well placed to lead the way”, and with Pharmacy2U about to open a facility that has the capacity to dispense millions of items each month, the battle for the online market has just begun.