It will have come as no surprise to those working within the community pharmacy sector in England that delivering services at the current funding level is not economically sustainable. However, an independent analysis of the costs of delivering NHS pharmaceutical services, commissioned by NHS England and published on 28 March 2025, has put numbers to the funding gap, which has built up over many years of real-terms funding cuts.

The analysis, which was conducted by Frontier Economics and IQVIA and informed the most recent community pharmacy funding deal, looked at data provided by 1,166 pharmacies across 102 companies. It found that the cost of delivering NHS pharmaceutical services across England in 2023/2024 is estimated to be £5,063m, against a funding level of £2,755m, leaving a shortfall of £2,308m (see Figure 1).

Commenting on the analysis, pharmacy minister Stephen Kinnock said at the time: “This stark analysis shows community pharmacies have been driven to the brink of collapse by years of underfunding and neglect.”

On 31 March 2025, Community Pharmacy England (CPE) announced that overall funding for the community pharmacy contract in 2025/2026 will rise to more than £3bn per year for the first time. However, this still leaves a substantial funding shortfall, even before taking into account the rise in employers’ national insurance contributions and the national living wage from April 2025, which pharmacy organisations have estimated will cost community pharmacies £200m per year in unplanned expenses. Some community pharmacies will also be hit by a reduction in business rates relief from April 2025, increasing operating costs further.

Economic analysis confirms the scale of a funding gap that we have been consistently warning policymakers of for many years

Mike Dent, director of pharmacy funding at Community Pharmacy England

Mike Dent, director of pharmacy funding at Community Pharmacy England, told The Pharmaceutical Journal that the economic analysis underlines the critical pressures that pharmacies are under, “confirming the scale of a funding gap that we have been consistently warning policymakers of for many years”.

“Whilst the community pharmacy contractual framework settlement did not provide an uplift to fully meet that gap, the government was clear that the settlement was as much as they could deliver given the current extreme pressures on public finances.

“Through the settlement we secured many crucial pledges from the government, including a firm commitment to work with us towards a sustainable funding and operational model for community pharmacy. The economic analysis’s full economic cost figure and trajectory analysis give a clear ambition to work towards and will be an important factor in the Department of Health and Social Care’s submissions to the Comprehensive Spending Review.”

The economic analysis modelled how costs might rise in the future, driven by an increase in existing commissioned activity, national living wage and other inflationary pressures and changes from April 2025. It estimated that the full economic cost of delivering NHS services could rise to £8,106m by 2029/2030. This assumes the structure of the community pharmacy sector does not change and services grow in line with dispensing. If services grow at a more rapid rate than dispensing (for example, twice the rate) the cost of provision could increase to £8,303m, the analysis estimates.

Cost of service provision

The economic analysis looked at the costs of providing NHS pharmaceutical services in the 12 months to 31 March 2024. Services that were within the scope of the analysis included NHS essential and advanced services, and over-the-counter healthcare sales. Services that were out of scope of the analysis included locally commissioned enhanced services and private services, as well as the sale of non-healthcare-related products.

The full economic cost, which refers to all costs associated with the provision of NHS pharmaceutical services, was broken down into four main categories: pharmacy-level costs; centralised and hub costs; hidden and structural costs; and cost of capital (see Figure 2).

The analysis highlighted that pharmacy level and centralised costs are likely to be measured most accurately in the estimates, whereas hidden and structural costs and the cost of capital are likely to be measured less accurately because of the availability of data.

The analysis looked at the costs of providing pharmacy services according to the size of the parent company. It found that the costs vary considerably both within each type of pharmacy group — single (1), small (2–5), medium (6–200) and large (≥201) — and across types. The overall cost is estimated to be highest for medium-sized companies (see Figure 2).

Sustainability of pharmaceutical services

It is estimated that between 45.5% and 96.6% of pharmacies have funding that is lower than pharmacy level and centralised costs and are therefore unsustainable in the short term. Between 97.7% and 100% of pharmacies have funding that is lower than their full economic cost and are therefore unsustainable in the long term (see Figure 3).

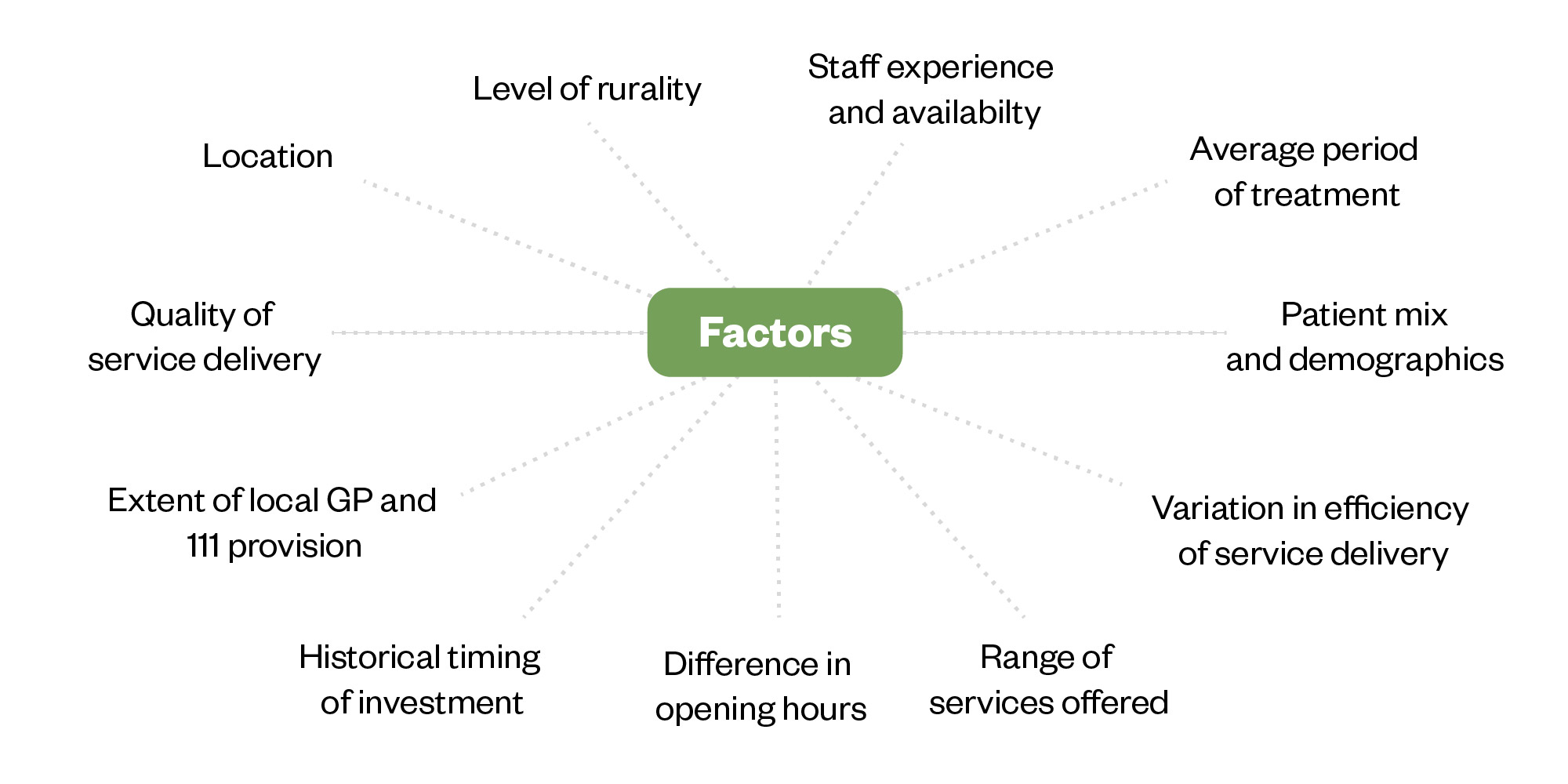

When the size of individual pharmacies is considered by calculating the costs incurred if each were to dispense 10,000 prescription items per month, cost estimates still vary (see Figure 3), suggesting that factors other than size contribute to the running costs (see Figure 4).

The Pharmaceutical Journal

National picture

The analysis estimated the full cost of providing pharmaceutical services across England by extrapolating the costs incurred in the 1,116 pharmacies in the sample to the 10,797 pharmacies across England at the end of November 2024 (see Figure 5).

The full cost of providing services was estimated at between £4,397m and £5,730m. “We estimated that full economic cost exceeded funding, across England in the 12 months to 31 March 2024, by £1,642m–£2,975m. Considering only pharmacy-level and centralised costs, these costs exceeded funding by £249m–£1,160m,” the analysis says.

This suggests that 78% of pharmacies across England (8,469 pharmacies) received funding that was lower than pharmacy level and centralised costs, which means they are not sustainable in the short term. Meanwhile, 99% (10,717 pharmacies) received funding that was lower than the full economic cost, making them unsustainable in the long term.

“There is a significant risk of interruption to NHS pharmaceutical services offered in these pharmacies, due to closure of these pharmacies, or due to operational pressures leading to a reduction in quality or scope of services provided,” the analysis says.

Profitability, cashflow and other pressures

The analysis also looked at other measures of financial sustainability, as well as the impact that financial pressures are having on the way that pharmacies are being run (see Box).

Box: Other findings

- Profitability: The analysis reported that 47% of pharmacies had negative Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA) in their last accounting year, indicating “significant financial distress”, with 55% of large chains having negative EBITDA;

- Cashflow: Almost one-quarter (24%) of parent companies (note those that provided data were either single pharmacies or small chains) had negative net current assets, indicating they may struggle to meet their debts over the next year;

- Other cost pressures: Some 37% of pharmacies would be deterred from closing because of the costs incurred in doing so (e.g. redundancy costs, lease commitments, loss of asset intended to support pension);

- Staff management: Almost all (99.9%) pharmacies reported significant changes in the management of staff (e.g. reducing hours, reducing overtime, changing staff mix);

- Operational changes: Almost all (99.9%) pharmacies reported significant changes in operations (e.g. changing opening hours, reducing or stopping free services, cancelling staff training);

- Financing ability: Three quarters (75%) of pharmacies reported significant change in financing their business (e.g. late payment of bills, extending loans, asking for wholesaler credit);

- Property management: Four in five pharmacies (81%) reported significant changes in property management (e.g. forgoing necessary maintenance, reduced normal property spend levels).

Source: ‘Economic analysis of NHS pharmaceutical services in England: final report’, March 2025

Sector responses

Following the announcement that community pharmacies in England have had their funding boosted by £617m over the next two years, pharmacy organisations were quick to highlight that a significant funding gap still remains.

The so-called ‘uplift’ will be spent plugging these gaps, rather than improving conditions for the workforce or ensuring fair remuneration

Statement from the Pharmacists’ Defence Association

In a statement, the Pharmacists’ Defence Association said that any additional funding will largely be absorbed by the financial shortfalls of years of chronic underinvestment.

“The newly published economic analysis underscores the dire financial state of the sector, with 47% of community pharmacies operating at a loss and defaulting on payments for essential stock,” the statement said. The so-called ‘uplift’ will be spent plugging these gaps, rather than improving conditions for the workforce or ensuring fair remuneration for those on the frontlines of patient care.”

Malcolm Harrison, chief executive of the Company Chemists’ Association, said at the time: “Given the findings of an economic independent review, it is clear there is a still a significant gap between the cost of delivering NHS community pharmacy services and what pharmacies will be paid.

“We look forward to working with the government to find ways to bridge this gap to ensure the future sustainability of the pharmacy network in England.”

We must acknowledge that ongoing economic pressures on pharmacies continue to bite

Tase Oputu, chair of the Royal Pharmaceutical Society English Pharmacy Board

Tase Oputu, chair of the Royal Pharmaceutical Society English Pharmacy Board, warned that, although the funding deal marks a significant step forward in addressing the long-term underinvestment in community pharmacy, “we must acknowledge that ongoing economic pressures on pharmacies continue to bite”.

The government and CPE also acknowledged that the funding agreement is a “first step” in addressing historical underfunding of the sector.

Kinnock added: “Community pharmacists are at the heart of local healthcare, and we want them to play a bigger role as we shift care out of hospitals and into the community through our ‘Plan for Change’.

“We’re working to turn around a decade of underfunding and neglect that has left the sector on the brink of collapse.

“This package of record investment and reform is a vital first step to getting community pharmacies back on their feet and fit for the future.”

CPE’s Dent told The Pharmaceutical Journal: “The committee reluctantly accepted the deal because it is the first significant increase in funding for the sector in ten years and the highest across the whole NHS, but we very much see this deal as the first step on a journey towards longer-term stability and security for the sector.”