Julie Lee / The Pharmaceutical Journal

Funding cuts in England have hit independent community pharmacies hard. Throw in price rises and medicines shortages, and there can be a significant knock-on effect. “When it comes to absorbing any financial shortfall, if the business is already at breaking point, it’s harder to find the fat in the system to ride out the storm,” says Stuart Gale, owner of the Frosts Pharmacy Group, which comprises three brick-and-mortar pharmacies in Oxfordshire and an online dispensing arm, Oxford Online Pharmacy.

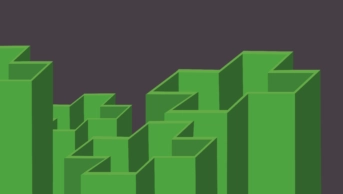

Market share for small independents has not changed significantly since 2016, falling slightly from 37.4% to 37.3%, a net drop of 26 pharmacies (see Infographic). However, according to Nitin Sodha, chair of the National Pharmacy Association (NPA), many independent contractors are “struggling to keep their heads above water”, given that funding is not keeping pace with the escalating and turbulent costs of medicines. “For most independent pharmacies, it’s a very challenging time, and that’s putting it mildly. There’s a daunting combination of squeezed funding, medicines shortages, inflated prices and hefty new regulations like the Falsified Medicines Directive,” he says.

For most independent pharmacies, it’s a very challenging time, and that’s putting it mildly

Difficult choices

In a recent survey of NPA members, 89% reported that their total monthly wholesaler bills now regularly exceed their NHS payments, and 54% said they are worried about survival. “Maintaining cash flow is a problem for a lot of independents in these circumstances,” says Leyla Hannbeck, director of pharmacy at the NPA.

Hannbeck says that most independents have taken steps to reduce costs to the business. “Many have been able to find savings in the back office — everything from utility bills to stationery,” she says. However, she admits that some have had to make difficult decisions about staffing, opening hours and service levels.

Gale adds: “Less money will lead to shorter opening hours for some, or cutting back on staff time and essential training; there will be less availability, restricting the time that pharmacists can dedicate to customers.”

For some independents, despite ploughing their own funds into their businesses to keep them afloat, their pharmacies are simply no longer economically viable (see Box). Alima Batchelor, head of policy at the Pharmacists’ Defence Association, points out that many independents are struggling because, unlike multiples, they do not have the “safety cushion” of a wholesaler subsidiary, which can be used to offset contract cuts and increases in drug prices.

She adds that, while independents may have a theoretical advantage over multiples, in terms of agility and the ability to adopt innovations, they may not have a practical advantage. “Innovation still needs to attract payment … and if clinical commissioning groups and local authorities are not commissioning … then this makes things really difficult,” she says.

Box: An independent at risk of closure

Nisha Kaur is an independent community pharmacist and joint owner of The Stoney Stanton Pharmacy in Coventry. The pharmacy, she says, is under threat of closure. There is currently a £13,000 shortfall between the money the business receives from the government annually and the amount it costs to run the pharmacy, which dispenses around 7,000 medicines per month. Kaur has had to inject £91,000 of family funds into the business to keep it afloat.

“It is looking increasingly likely that the pharmacy may have to cut home deliveries to buy more time,” says Kaur. “It’s very possible that we will have to close down within a month or two.”

Invest to survive

Gale, however, sees investing in services as essential to an independent pharmacy’s survival. “It’s tempting to cut back but, in this situation, we need to continue to grow,” he says.

It’s tempting to cut back but, in this situation, we need to continue to grow

Mike Holden, principal associate at consultancy firm Pharmacy Complete, says that many independents are having to look at new income streams to supplement their revenue and profitability. “Where they can invest the time and resource, they are developing private vaccination services, diversifying into services such as aesthetics and extended self-care markets and maximising their NHS service opportunity,” he says. But often this means having to work extended hours to deliver a core dispensing service and additional services on top.

Source: Courtesy of Mike Holden

Mike Holden, principal associate at consultancy firm Pharmacy Complete, says that many independents are having to look at new income streams to supplement their profitability

Gale suggests the only NHS services that really make a difference to profitability are medicines-use reviews (MURs), the new medicine service (NMS) and flu vaccination, so he has focused on diversification away from the NHS. “This has included the development of our walk-in travel clinics and making the online dispensing arm of the business one of the best in the industry,” he says.

“The new services being run out of our brick-and-mortar chemists have been really well received and so we will continue to develop this element of the business, as well as increasing NHS numbers,” he adds.

James Tibbs, who runs AR Pharmacy in Hampshire, agrees. He made a decision to invest in pharmacy services six years ago when he took over management of the business from his parents in-law. His aim was to create a health hub for the local community.

“If anything, we have ramped up service provision even more since the cuts were announced,” he says.

If anything, we have ramped up service provision even more since the cuts were announced

AR Pharmacy was accredited as a ‘Healthy Living Pharmacy’ in 2013 — the first independent in Hampshire and the Isle of Wight Local Pharmaceutical Committee to be recognised as such. Tibbs explains that the services he now offers have offset the funding cuts. “Our items have gone up 6.5% to 7.0% year-on-year, which is way above the national average. And our turnover has plateaued rather than gone down over the past three years, despite the cuts,” he says. “It takes a lot of effort, but you can do it,” he adds.

Source: Courtesy of James Tibbs

James Tibbs, who runs AR Pharmacy in Hampshire, says the services he now offers have offset the funding cuts, although this has taken a lot of effort to achieve

Tibbs’s pharmacy dispenses about 22,500 items per month, a figure that is set to increase by 2,000–3,000 items per month after he secured a contract to dispense take-home monitored dosage systems for Southampton General Hospital. But despite 90% of his income coming from NHS dispensing, Tibbs is adamant that providing services is the way forward. “It’s more about the services and we are at the centre of that. People refer into us [for the services] and [consequently] use our pharmacy for their prescriptions.”

The pharmacy carries out targeted MURs and NMS consultations in close collaboration with the local surgeries. It also provides flu vaccinations, NHS health checks, and smoking cessation and weight management services.

Like Gale, Tibbs has also developed several private services, including a travel health clinic and diabetes testing service. “For all of the services, I make sure that, before I do them, I look at the pharmaceutical needs assessment and talk to the clinical commissioning group to see what targets aren’t being met,” he explains. As a result, the local surgeries are on board and refer people to the pharmacy.

Setting up private pharmacy services can be both professionally and financially rewarding for pharmacists, says Hannbeck, and can also increase footfall to the pharmacy. However, she points out that the scope for private services is greater in more affluent areas and is not necessarily an option for pharmacies serving more deprived populations.

This is a point that Batchelor makes, too. “If the government continues to cut the overall contract sum while failing to provide resource for other service-based activity, then the forecast will be bleak for those locations in deprived areas where the local population cannot support their pharmacy by paying for additional services,” she says.

Consolidation versus expansion

Providing private services is just one way that independents are generating extra income.

Gale has incorporated a local GP surgery, which was at risk of closing down, into one of his branches. “We secured the service for local residents and helped maintain income for the pharmacy that would have been lost. It’s also a great opportunity for us to work together as a medical team,” says Gale.

Tibbs has secured extra income through renting out his eight — soon to be ten —consultation rooms to other healthcare professionals, such as counsellors, chiropodists and chiropractors. “The huge benefit is that direct link with other healthcare professionals, which helps us to achieve our ambition of the pharmacy as a health hub,” he says.

Despite their successes, expansion through the acquisition of branches is not on the cards for either Gale or Tibbs; Gale has not bought any new pharmacies since 2010. “We have taken the strategic decision to consolidate and build on what we have rather than continue to expand,” he says.

We have taken the strategic decision to consolidate and build on what we have rather than continue to expand

Tibbs too has decided to focus on his current pharmacy rather than purchasing more. But he has not ruled out future expansion. “If deregulation of ‘hub and spoke’ [dispensing] happens, it opens up the market to allow us to outsource more time-consuming dispensing, such as compliance aids, so that we can continue to focus on service delivery.” This, he says, will make it more financially viable to expand the business and look into future acquisitions.

NHS England is reconsidering changes to government regulations around hub and spoke dispensing as part of its ten-year plan. Under current legislation, the model is permitted within the same pharmacy business but not across different entities. “When the legislation goes through, if we are going to survive, independents are going to have to work together in some sort of capacity,” says Tibbs.

He acknowledges that this could be difficult given that they compete for business but says: “You have to find out best practice from other people, you have to utilise other people’s resources and work together.”

The outlook

Despite all of the challenges, Sodha is confident that there is a commercially viable and professionally rewarding long-term future for the independent sector, provided pharmacies can weather the current storm. He encourages contractors to embrace change and shape the future rather than “let it take them by surprise and overwhelm them”.

“In particular, there is a challenging digital journey ahead for many pharmacies and those that don’t take the journey may not survive into the long term,” he says.

Hannbeck highlights ‘clicks and mortar’ as an increasingly prominent business model in many sectors of the economy, and one that she believes could be suited to many pharmacy businesses. “This model combines the benefits of fast online transactions and the face-to-face service at which community pharmacy has always excelled,” she says.

Gale believes there will always be a need for local pharmacies on the high street but stresses that they must continue to deliver value through efficiencies. “Pharmacists are perfectly positioned to step in and support the NHS in these testing times. The more services they can offer, the more likely people will be to gravitate towards them for their day-to-day healthcare needs.”