Mike Dent

There is an air of mystery surrounding the Leeds dispensing facility of Pharmacy2U, the UK’s largest distance-selling pharmacy. Before The Pharmaceutical Journal’s visit, there is much toing and froing over permission to photograph inside the company’s facility (they do not call it a factory). But, eventually, our photographer is approved and we are allowed exclusive ‘Gregg Wallace-style’ access to the warehouse.

On the morning of our visit, Pharmacy2U features in The Metro’s top ten apps for health and wellbeing, alongside others for mindfulness and fitness tracking. The blurb describes the company as “Amazon for repeat prescription medication” — a comparison that Mark Livingstone, chief executive officer at Pharmacy2U, is pleased with.

“I definitely think there is an analogous business that we’re building in which you could compare it to Amazon,” he smiles.

Livingstone looks relaxed as we sit in an unremarkable office building on an industrial estate about six miles outside of the city centre. “Obviously Amazon for drugs is great … people immediately get what it is. But, more importantly, what I love is the ethos of Amazon, which is finding a different need that a customer has and servicing it in a different way, and having the kind of resilience and long-term view of how long it takes.”

Source: Dave Phillips

Mark Livingstone, chief executive at Pharmacy2U, has big plans for the business

However, Livingstone is quick to reassure that he is not building a business to sell to Amazon. “I’ve already done that. I sold my last business — LoveFilm — to Amazon, so I’ve been there before,” he says. However, he caveats this with an acknowledgement that good businesses often get sold to bigger businesses. “First and foremost, we are building a brilliant business,” he says.

Aggressive marketing

Making a top ten apps list perhaps reflects the success of Pharmacy2U’s extensive marketing campaigns, which have been criticised for being too aggressive and confusing for patients.

In July 2018, the Advertising Standards Agency upheld a complaint about advertisements that appeared on Twitter and the TV, which claimed Pharmacy2U could save the NHS £300m by managing repeat prescriptions[1]

. Livingstone admits that “we were somewhat … cavalier in making the claim”, but points out that the advertising watchdog did not disagree with the basis of the calculation — just that the £300m sum assumed all repeat prescriptions in England were dispensed by Pharmacy2U, whereas in reality it has only 1–2% of the market.

A survey conducted by the National Pharmacy Association (NPA) in 2017 revealed that 90% of the 283 pharmacists who responded said at least one of their patients had been confused by unsolicited Pharmacy2U marketing materials, with 7% of respondents estimating that 50 or more of their patients had thought it was official NHS mail[2]

. Some patients assumed the marketing literature had come from their GP surgery and some felt obliged to fill in the form to maintain their usual service from their GP and pharmacy.

In October 2015, before Livingstone joined the company in July 2016, Pharmacy2U was fined £130,000 for selling information about customers to marketing companies. Julian Harrison,, its then commercial director, was subsequently suspended from the General Pharmaceutical Council’s register for three months[3]

. Daniel Lee, the company’s founder and its then superintendent pharmacist, was issued with a warning. Lee left the company in June 2019.

It’s very easy to get 99% of the noise from 1% of a very embittered faction of the industry that believes we are not trying to do something good

Livingstone seems untroubled by the criticism. “I’m thick-skinned. And I also believe if you’re not getting any complaints, you’re not doing something right, to a degree.”

He adds that “it’s very easy to get 99% of the noise from 1% of a very embittered faction of the industry that believes we are not trying to do something good”. He sees this as “the price of being a new entrant and a positive disruptor”.

It’s this positive disruption that led Livingstone to the world of pharmacy in the first place. “I look for businesses that are very undisrupted. The first chemist opened its doors in 1734, so you’ve got almost a 300-year-old infrastructure … and actually, today, not much has changed.”

Livingstone’s background is in running subscription-based e-commerce businesses and that is how he views Pharmacy2U, which he sees as a pioneer.

“I love the … way in which we’ve carved out a very unique service, which is now being adopted by everyone who said that distance dispensing at scale would never work,” he says. “Boots now does it, LloydsPharmacy now does it — everyone else now does it.”

Pharmacy2U was the first distance-selling pharmacy to be established in the UK in 1999. It merged with online pharmacy Chemist Direct in July 2016 and the combined business now offers a home delivery prescription service for NHS and private patients, online doctor consultations, and more than 6,000 health and wellbeing retail products (see Box).

Plans for growth

Livingstone has big plans for the business. On the wall behind him is a poster advertising the company’s new ‘mega facility’ in Leicester — six times larger than this one in Leeds and due to be fully operational by 2021. Together, the two facilities will give Pharmacy2U the capacity to dispense 7.5 million items per month. And there is a third facility planned for development another five years down the line.

This potential capacity may seem huge compared with the 7,000 items per month currently dispensed by the average brick-and-mortar pharmacy, but would still make up only around 8% of the 1.1 billion prescription items dispensed in England in 2018.

Over the past 12 months, Pharmacy2U has recruited around 200,000 patients and around 300,000 patients have used its NHS prescription service during that time. On average, Pharmacy2U dispenses more than 500,000 prescription items every month, reaching a record of 583,000 in May 2019, and this has increased at a rate of 50% year on year. However, Pharmacy2U declined to provide figures on patient attrition rates and on the demographics of patients registered with the company.

Livingstone says the business is “very much on a mission to become a pretty significant part of the market”.

“We think that there is nothing stopping distance dispensing becoming 10–15% of the £8bn [prescription] market and, clearly, we want to be the market leader within that sector,” he says.

But Phil Day, superintendent pharmacist at Pharmacy2U — who has been with the company for 20 years following five years at Boots — is keen to quash rumours that the company wants to expand at all costs.

Source: Dave Phillips

Phil Day, superintendent pharmacist at Pharmacy2U, is keen to quash rumours that the company wants to expand at all costs

“There’s maybe a misconception that we want to dominate the world and shut every other pharmacy, and that’s absolutely not what we’re about at all,” says Day, stressing that there is a definite need for local pharmacies.

We don’t just take all business. We have proactive policies and procedures that identify patients who may be vulnerable

“There will always be a need for people who need to see someone, who need screening, who need it now, who need a bit of extra support and encouragement, and we’re absolutely behind that,” he says, explaining that Pharmacy2U identifies and contacts patients who are not suitable for distance dispensing, such as those who require extra support, older patients and those who need the items urgently.

“We don’t just take all business. We have proactive policies and procedures that identify patients who may be vulnerable,” Day explains, adding that sometimes people will set up an account and put their delivery address as their local pharmacy, clearly not understanding how Pharmacy2U works.

“We contact them before we dispense to ask, ‘do you realise who we are and where we are?’.”

But, he adds, there is a large proportion of patients who have very simple, uncomplicated repeat prescriptions, who know how to take their medicines and who will benefit from an online service.

Breaking into services

Pharmacy2U is not planning to stick only to dispensing and has plans to start delivering the new medicine service (NMS) in the coming month s. “My belief is that we, first and foremost, will come in and take up a significant market share within repeat prescriptions … through the post to make it more convenient and efficient,” says Livingstone. “But actually, we then have a multimillion user base; how can we then leverage that? We do believe that [services] will be a developing part of our proposition.”

Pharmacy2U has struggled to provide advanced services, such as medicines use reviews (MURs) and the NMS, owing to difficulties with the establishment-based remuneration model and the logistics of obtaining patient consent. “With MURs, there’s a cap of 400 patients per year — which, to us, is a drop in the ocean,” says Day. “And it’s also very difficult to jump over the hurdles for telephone MURs because every patient has to be individually confirmed by NHS England … even to get consent to call in the first place.”

The NMS is a better proposition because there is no cap or requirement for NHS England to verify each patient before the service is undertaken. Pharmacy2U is currently working with NHS England to try to find an acceptable and easily accessible way to obtain patient consent digitally. If that goes to plan, Pharmacy2U could carry out up to 3,000 NMS appointments per month, depending on uptake.

The company has also been involved in a UCL research study to assess the benefits of pharmacist advice by telephone for patients taking long-term medicines[4]

. “We interviewed around 600 patients who had long-term conditions and we followed up with them after 4–6 weeks, and then followed up with them after that to see if any hospital admissions were reduced or any health outcomes had benefited from that,” explains Day.

“We found there was a significant difference. So, we’ve taken our findings and we’re looking … to see how we can support, at scale, the improved adherence of patients who take medications for long-term conditions.”

I definitely wouldn’t say no to the possibility of buying brick-and-mortar pharmacies because I think ‘omni-channel’ is something that might be interesting in the future

Day says that if there is a move towards a more service-based pharmacy contract, then more services will be part of the plan. What’s more, Livingstone does not rule out the possibility of Pharmacy2U buying brick-and-mortar pharmacies in the future to facilitate this.

“I definitely wouldn’t say no because I think ‘omni-channel’ and having that combination of face-to-face and distance dispensing, is definitely something that might be interesting in the future,” says Livingstone. “Am I strategising to do it? No. But could I perceive there could be a really good angle on that? Absolutely.”

He can also see a time when Pharmacy2U could become the non-multiple hub-and-spoke solution for independent pharmacy. “We’ve thought about it,” he says. “I think community pharmacy will have to have some kind of hub-and-spoke solution to make sure it remains competitive, and certainly what we do is very analogous to a hub and spoke.”

But, for now, dispensing is the focus.

Inside the facility

In contrast to the unremarkable office building, the dispensing facility — just a short walk away — is anything but. At 30,000 square feet, spread across two levels, it is huge. And the noise is incredible. There are trays full of medicines whizzing up and down chutes, robots picking packs, and machines making bespoke cardboard boxes.

Source: Dave Phillips

The Pharmacy2U dispensing facility covers 30,000 square feet, spread across two levels

Source: Dave Phillips

Trays travel around the facility and medicines are added by operations staff or robots

Source: Dave Phillips

Medicines are picked by three robots 24 hours per day

The facility is full of operations staff — 76 members of staff on a day shift and 67 members of staff on a late shift — all clad in high-visibility vests. What is striking, however, is the small number of pharmacists needed for such a large operation. There are only five or six pharmacists on a daytime shift and one on a late shift, digitally checking the 500,000 prescription items dispensed every month. Some of the pharmacists work from an office within the facility and some work remotely, but The Pharmaceutical Journal was not permitted to interview them. There is also a 24-strong clinical team of accredited checking technicians, dispensers and endorsers.

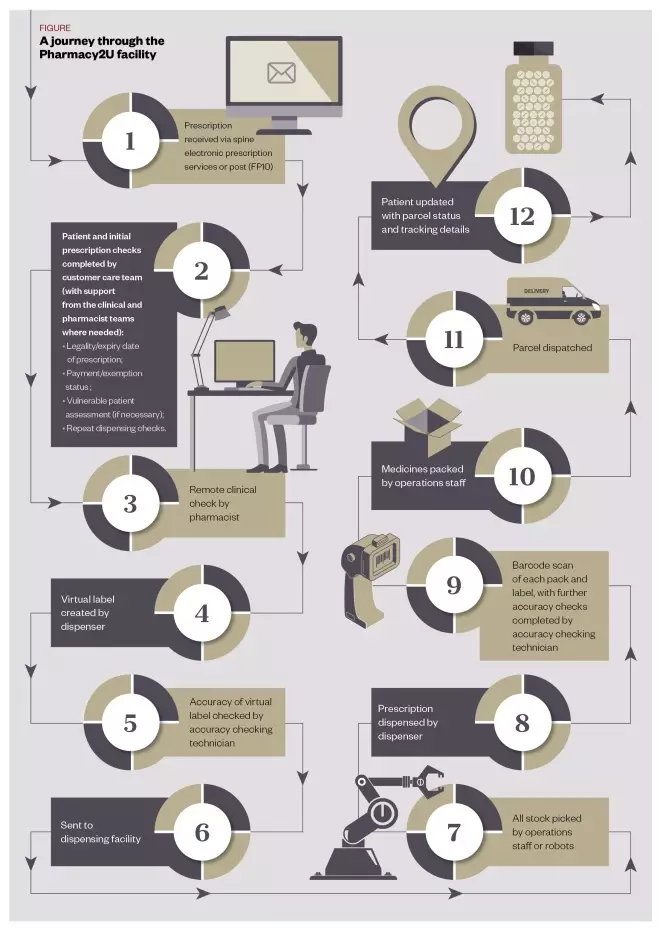

The dispensing process is not dissimilar to the one employed in hospital pharmacies: the pharmacist performs a clinical check upfront and the rest is dealt with by the operations staff, dispensers and accredited checking technicians (see Figure). If a patient needs to be contacted, they will be reached out to by the vast bank of customer care operators, the pharmacist team or the clinical team, depending on the nature of the information required or being imparted.

Figure: A journey through the Pharmacy2U facility

Prescriptions are clinically checked by a pharmacist upfront and the rest of the process is dealt with by operations staff, dispensers and accredited checking technicians

In the dispensing facility, medicines are stored in one of three large robots that house 80,000 packs, in a manual picking zone — for bulky items or packs that have been part dispensed — or in a ‘pick by light’ area for fast-moving items, where flashing lights tell operations staff what to pick. There are also areas with fridges and controlled drugs storage.

Once all items are picked, the tray moves on to the dispensing area, where the barcode on each pack is scanned and matched with a barcode on the label. If an item has ended up in the tray by error or if an item is missing, this will also be flagged by the system.

“Anything where human intervention has been undertaken — so part packs … any controlled drugs — they’re all double checked again by an [accredited checking technician] at a station in [the dispensing] area,” explains Day.

Finally, the items are transferred to a packing station. “Again, it’s all controlled by barcode. They verify that the items are for the correct patient and enter a pack count to ensure they’ve got the right number of items in the box.”

The facility is full of cameras too, on the robots and in all packing, assembly and dispensing work stations, so if there are any snags in the system, or near misses identified, a quality assurance team can investigate them and implement any necessary IT changes or extra training.

Day emphasises that the process is very safe, with a 99.9% accuracy rate. “For example, we don’t really have a problem with things like lookalikes or like-sounding drugs to the extent that a community pharmacy would,” he says, because medicines are stored randomly and catalogued by barcode.

Growing pains

Pharmacy2U’s approach — to both dispensing at scale as well as its marketing campaign — has sparked controversy at times. As Day puts it, “you can’t grow without growing pains”. The Royal Pharmaceutical Society has expressed concerns that Pharmacy2U could threaten the brick-and-mortar network by taking away the supply function. And the NPA has spoken out about how Pharmacy2U’s advertisements cause confusion for some patients. The latter has also highlighted the value of face-to-face consultations, saying that internet and mail order pharmacies are in no way equivalent to local pharmacies, and cannot give the same level of support.

Livingstone hopes that Pharmacy2U’s business model will have a positive impact on community pharmacy. “If we get this right, I honestly believe in three or four years’ time, you’ll be able to look at the funding model for community pharmacy … and by us being a distance dispenser at scale, it will have liberated community pharmacy to be rewarded for the triage services they provide face-to-face to the community,” he says.

“I think we will then be viewed as the catalyst to move the funding model on, not that we somehow ate community pharmacy’s breakfast.” But the company’s plans for massive expansion and the potential for it to provide more services may cause problems for some in the sector.

Some would describe Pharmacy2U as a dispensing factory, and no doubt Gregg Wallace would be impressed. But with only half a dozen pharmacists overseeing more than 500,000 prescriptions per month, there are obvious implications for the pharmacist workforce. If it is to counter the threat from Pharmacy2U, community pharmacy will need to regain the initiative in the rapidly expanding digital pharmacy space.

Box: Money talks

Pharmacy2U was established in 1999 and, in July 2016, merged with online pharmacy Chemist Direct to become the largest digital pharmacy business in the UK. The merger followed a £10m investment from private equity firm the Business Growth Fund.

In April 2018, Pharmacy2U secured a further £40m of investment from private equity firm G-Square, a London-based healthcare specialist. However, the company is yet to make a profit, according to the latest financial report for the year ended 31 March 2018, filed with Companies House in November 2018. The report shows that the group made a loss of £12.1m to March 2018 (down from £20.3m in 2017). However, revenue increased to £43.2m (from £25.8m in 2017), largely owing to strong growth in NHS patient recruitment.

“We could stop growing and become profitable now, but that’s not a challenge,” says Mark Livingstone, chief executive at Pharmacy2U.

The challenge, he says, is getting to the size we want to be and becoming profitable. “And even then, we’re not a terribly profitable company. But we are a very predictable and a very long-term and solid company. Both public markets and private markets like those types of companies, as well as those ones that make gazillions of [pounds].”

The 2018 financial report says that the group “made a profit, pre-acquisition marketing, in August 2018” and expects profitability to increase throughout the remainder of that current financial year and beyond.

- This article was corrected on 15 July 2019 to amend the record number of prescription items dispensed by Pharmacy2U, from 640,000 in April 2019 to 583,000 in May 2019

References

[1] Clews G. Advertising watchdog says Pharmacy2U ads ‘misleading’. 2018. Pharm J 2018;301:7915. doi: 10.1211/PJ.2018.20205196

[2] The Pharmaceutical Journal. Pharmacy2U criticised for confusing marketing tactics. Pharm J 2017. doi: 10.1211/PJ.2017.20203482

[3] The Pharmaceutical Journal. Pharmacy2U’s commercial director suspended from the register over data sales. Pharm J 2016. doi: 10.1211/PJ.2016.20201215

[4] Lyons I, Barber N, Raynor DK & Wei L. The Medicines Advice Service Evaluation (MASE): a randomised controlled trial of a pharmacist-led telephone based intervention designed to improve medication adherence. BMJ Quality and Safety 2016;25(10):759–769. doi: 10.1136/bmjqs-2015-004670