Download the PDF of the full information graphic

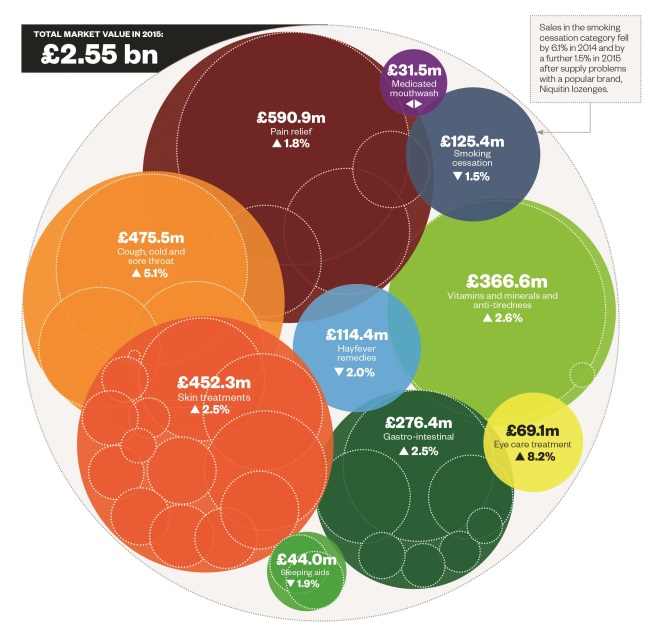

Breakdown of market value by category

OTC market sales are dominated by products for pain relief, coughs and colds, and skin treatments.

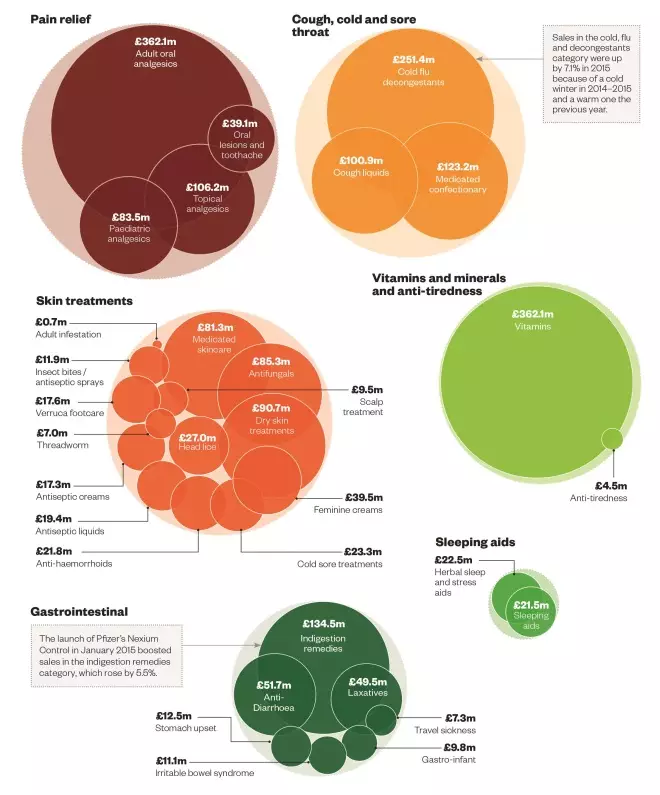

Individual category breakdown

The breakdown for each category shows that adult oral analgesics and vitamins have the highest sales, at £362.1m each in 2015.

Top 50 Brands

RB manufactures 10 of the products in the 50 best-selling brands of 2015, followed by GSK with 7 and McNeil with 5. Retailers’ own label products have a 19.0% share of OTC market sales, a figure that has remained largely stable for the past three years (19.3% in 2014 and 19.4% in 2013).

| 2015 (2014) | Brand name | Sales (£m) | Manufacturer |

|---|---|---|---|

| 1 (1) | Own label | 484.2 | Various |

| 2 (2) | Nurofen | 117.5 | RB |

| 3 (3) | Nicorette | 64.6 | McNeil |

| 4 (4) | Calpol | 62.4 | McNeil |

| 5 (6) | Lemsip | 61.2 | RB |

| 6 (5) | Gaviscon | 59.7 | RB |

| 7 (7) | Canesten | 40.1 | Bayer |

| 8 (8) | Solpadeine | 39.5 | Omega Pharma |

| 9 (11) | Optrex | 38.0 | RB |

| 10 (10) | Benylin | 36.8 | McNeil |

| 11 (12) | E45 | 35.5 | RB |

| 12 (9) | Voltarol | 34.4 | Novartis |

| 13 (13) | Halls | 33.2 | Mondelez International |

| 14 (14) | Strepsils | 32.3 | RB |

| 15 (18) | Sudafed | 32.1 | McNeil |

| 16 (17) | Nicotinell | 31.5 | Novartis |

| 17 (16) | Imodium | 31.1 | McNeil |

| 18 (15) | Rennie | 30.1 | Bayer |

| 19 (19) | Seven Seas | 28.1 | Seven Seas |

| 20 (20) | Beechams | 23.8 | GSK |

| 21 (22) | Covonia | 23.5 | Thornton & Ross |

| 22 (24) | Corsodyl | 23.0 | GSK |

| 23 (23) | Anadin | 22.7 | Pfizer |

| 24 (25) | Berocca | 21.2 | Bayer |

| 25 (28) | Well ‘Kid/Man/Teen/Woman’ | 20.4 | Vitabiotics |

| 26 (26) | Panadol | 20.3 | GSK |

| 27 (27) | Vicks | 20.2 | Proctor & Gamble |

| 28 (29) | Pregnacare | 19.0 | Vitabiotics |

| 29 (21) | Niquitin | 17.1 | GSK |

| 30 (33) | Deep Heat | 15.7 | Mentholatum |

| 31 (30) | Senokot | 15.4 | RB |

| 32 (32) | Centrum | 15.4 | Pfizer |

| 33 (54) | Buttercup | 15.1 | Omega Pharma |

| 34 (34) | Bonjela | 15.0 | RB |

| 35 (31) | Nytol | 14.0 | Omega Pharma |

| 36 (37) | Piritize | 14.0 | GSK |

| 37 (38) | Night Nurse | 13.6 | GSK |

| 38 (36) | Clean & Clear | 13.2 | Johnson & Johnson |

| 39 (35) | Dettol | 13.0 | RB |

| 40 (40) | Scholl | 12.9 | RB |

| 41 (43) | Jakemans | 12.6 | LanesHealth |

| 42 (39) | Olbas | 12.5 | LanesHealth |

| 43 (44) | Abusol | 11.9 | Johnson & Johnson |

| 44 (45) | Femfresh | 11.8 | Church & Dwight |

| 45 (42) | Otrivine | 11.5 | Novartis |

| 46 (47) | Care | 11.5 | Thornton & Ross |

| 47 (41) | Savlon | 11.0 | Novartis |

| 48 (57) | Haliborange | 11.0 | Seven Seas |

| 49 (49) | Zovirax | 11.0 | GSK |

| 50 (52) | Dulcolax | 10.4 | Boehringer Ingelheim |

References

Source: Data and insight provided by IRI Group Ltd. Data is for sales of OTC products (including own-label and generic) from all multiples and independent pharmacies and most supermarkets and grocery outlets in Great Britain for 52 weeks to 26 December 2015.