LEWIS HOUGHTON/SCIENCE PHOTO LIBRARY

Politicians should commit to reviewing the prescription charge system in England, the Royal Pharmaceutical Society (RPS) has said, following a government announcement that the fee will rise to £9.90 per prescription item.

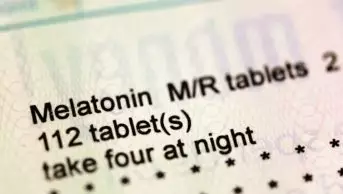

The Department of Health and Social Care (DHSC) announced on 5 April 2024 that the NHS prescription charge will rise from £9.65 to £9.90 per item from 1 May 2024.

The cost of a three-month prescription pre-payment certificate (PPC) will rise from £31.25 to £32.05, and the cost of a 12-month PPC will increase from £111.60 to £114.50.

The DHSC announced that the cost of an HRT-specific PPC, which is valid for one year, will rise from £19.30 to £19.80.

Responding to the prescription fee increase, Tase Oputu, chair of the RPS English Pharmacy Board, said that the rise in charges would hit working people on low incomes the hardest.

“Patients shouldn’t have to make choices which involve rationing their medicines. No one should face a financial barrier to getting medicines which a health professional has prescribed as necessary.

“The consequences of the relentless rise in prescription charges are well known. If you can’t afford your medicines, your condition can worsen, which leads to poor health, lost productivity and increases the risk of hospital admission, piling pressure on the NHS.

“In a general election year, I hope that political parties can commit to properly reviewing this complex and unjust system. It is high time this stealth tax was abolished.”

This is the second year running that prescription charges have been increased, following a freeze in 2022.

In January 2023, the government announced that it was introducing a PPC that would cover all HRT items that are licensed to treat menopause symptoms, which would be priced at twice the single prescription charge.

Responding to the 2024 fee change, Janet Morrison, chief executive of Community Pharmacy England, said prescription charges were “a tax on the vulnerable, which forces pharmacy teams to act as tax collectors on top of the intolerable wider pressures that community pharmacy is facing”.

“Yet again community pharmacies must be the bearers of bad news as the government decides to raise the NHS prescription charge,” she said.

“As the cost of living continues to put strain on the most vulnerable in society, many patients will have to make unbearable decisions about which medicines they can afford to pay for.”

Revenue from prescription charges and PPCs in England totalled £651.9m in 2021/2022, but a survey of pharmacists by the RPS and the Pharmacists’ Defence Association, published in February 2024, showed that more than a third of pharmacists (35%) reported an increase in patients declining prescriptions in the past 12 months, with 97% of respondents seeing cases where patients declined some of the medicines on a prescription owing to cost.

In March 2024, the Prescription Charges Coalition — which represents more than 50 healthcare and charity bodies, including the RPS — delivered an open letter to the government calling on it to freeze prescription charges for 2024 and 2025.

In a statement published following the prescription charge price increase, the National Pharmacy Association (NPA) said that data from a survey it commissioned showed that antibiotics, painkillers, asthma inhalers, blood pressure medication and antidepressants are among the most commonly reported medicines not taken owing to the prescription charge.

Nick Kaye, chair of the NPA, said: “As pharmacists, we understand the healing power of medicines. So naturally we oppose arbitrary barriers to people getting the medicines they need. This is a tax on the working poor that deepens the cost-of-living crisis for them. As pharmacists, we are healthcare professionals and have no interest in being tax collectors.”