Shutterstock.com

With some calling them “one of the most important developments in cardiology in 2015”[1]

the US approval of the first two proprotein convertase subtilisin/kexin type 9 (PCSK9) inhibitors alirocumab (Praluent, Sanofi/Regeneron) and evolocumab (Repatha, Amgen) in 2015 raises many questions about the ultimate utility of this new class of injectable cholesterol-lowering drugs. The issue is compounded by the high cost of these treatments, estimated at US$5,000 to US$10,000 per patient per year, with cost-effectiveness arguments suggesting they are poor value for money[2]

. Concern about the lack of long-term outcomes data, questions about safety, particularly related to increased rates of diabetes, and the size of the patient population for whom the drug will be prescribed, all add up to an uncertain future for these drugs[3]

.

Birth of PCSK9 inhibitors

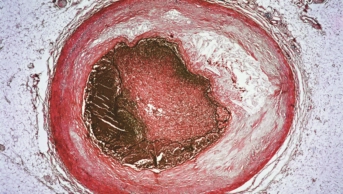

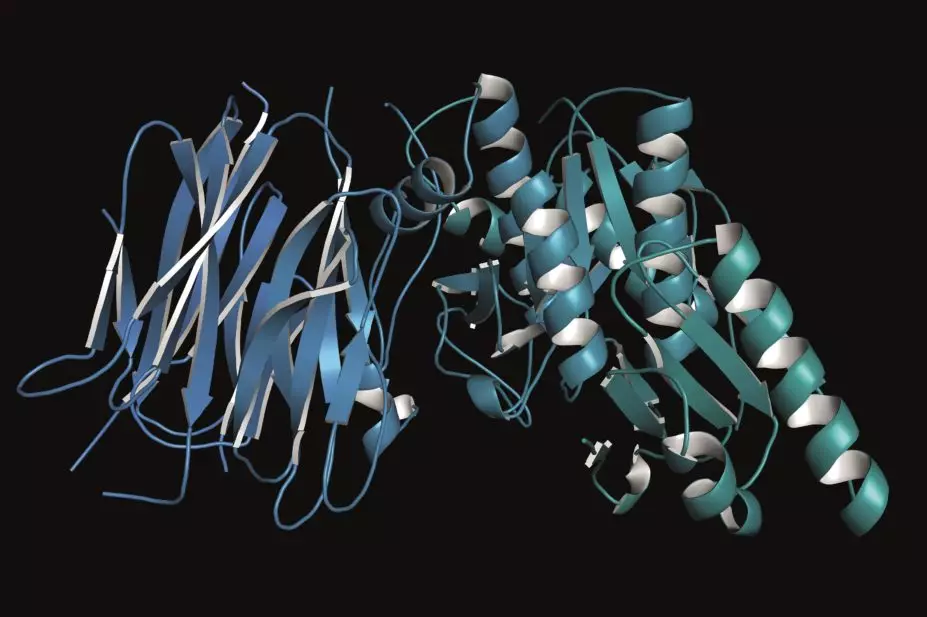

In 2003, several teams of researchers in Canada, France and United States (Texas) discovered an enzyme encoded by the gene PCSK9, which binds to the receptor for low-density lipoprotein (LDL) cholesterol[4],[5],[6]

. By blocking PCSK9, LDL cholesterol can be removed from the blood[7]

. This discovery led to the development of human monoclonal antibodies that bind to and inhibit PCSK9.

In June 2015, the US Food and Drug Administration’s (FDA) endocrinologic and metabolic drugs advisory committee reviewed alirocumab and evolocumab, the first PCSK9 inhibitors to be submitted for approval[8]

. A month later a systematic review[9]

and meta-analysis of 24 studies in 10,159 patients established the LDL-lowering capacity of the PCSK9 inhibitors, but the included studies did not have patient-level data, were small in size with few events, and conducted short follow up. Despite these caveats, the systematic review suggested that these agents, when used in patients with high cholesterol at risk of cardiovascular disease, appear to be effective and safe, and reduce all-cause mortality, cardiovascular mortality and heart attacks[9]

. The authors concluded there was “an apparently similar level of safety and an important preliminary signal of survival benefit compared with no anti-PCSK9 treatment”[9]

. Subsequently, the FDA panel recommended approval for alirocumab in July 2015 and for evolocumab in August 2015[10]

.

In October 2015, US pharmacy benefits manager giants Express Scripts (responsible for processing and paying prescription drug claims) agreed to cover the PCSK9 inhibitor alirocumab at a wholesale price of US$14,600 per year (evolocumab’s wholesale price is US$14,100 per year)[11]

. Express Scripts’ chief executive Steve Miller said the company agreed to cover both treatments but at considerable (undisclosed) discounts. “It is clear that PCSK9 inhibitors are on a path to become the costliest therapy class [the United States] has ever seen,”[12] he said.

The National Institute for Health and Care Excellence (NICE), which is responsible for appraisals of medicines and health technologies in the UK, initially rejected both products for funding on the NHS based on poor cost-effectiveness in November 2015[13]

. The New England Comparative Effectiveness Public Advisory Council called these drugs “effective but overpriced”[14]

. In February 2016, NICE reversed its decision on evolocumab, and approved it for some patients with primary hypercholesterolaemia or mixed dyslipidemia. Only patients who have persistently high levels of LDL cholesterol despite prior therapy, and who are contraindicated or intolerant of statin therapy, are eligible. These patients can get evolocumab if Amgen supplies it at the discount agreed in a patient access scheme[15]

.

Overexpectations

As of March 2016, it appears that some US cardiologists have embraced PCSK9 inhibitors, especially in patients with familial hypercholesterolaemia, but there are many challenges ahead until these drugs achieve “blockbuster” status. Their slow uptake has been reflected in languid product sales both in the United States and the UK. For example, fourth quarter 2015 UK sales of alirocumab amounted to €5m, despite analysts estimating sales would reach €41m or more[16]

. For its first full quarter on the market, analysts projected sales of alirocumab would be US$21m in the United States, but sales totalled US$4m[17]

.

Pharmaceutical market analysts are seeing substantial roadblocks as more expensive treatments try to get a foothold on the market[18]

. It seems the makers of PCSK9 inhibitor drugs have used journal publications and mainstream media to stoke interest, even though the treatments have only preliminary data and are approved on the basis of surrogate markers. One of the big roadblocks is the big payers, particularly large government drug plans such as Medicaid in the United States, which are increasingly stringent with their prior authorisation processes. Added to these complexities are clinicians who are cynical and are not yet convinced of the overall benefits and safety of these new injectable (and more difficult to administer) treatments.

Marilyn Mann, an active researcher on familial hypercholesterolaemia, and a member of the editorial board of the medical journal Circulation, has followed these drugs closely and attended the FDA advisory committee meetings discussing the approval of the PCSK9 inhibitors. She became interested in researching treatment options for her then teenage daughter, who has heterozygous familial hypercholesterolaemia, a genetic disease that causes very high LDL cholesterol.

In private correspondence on 12 February 2016, she reflected on the caution of many clinicians with respect to PCSK9 inhibitors, and said we need to wait for outcomes data in order to better establish the drugs’ risks and benefits. Three large outcomes trials are already in progress and the first outcomes data may be available in late 2016.

Her hesitancy is justified when drugs that seem safe in clinical trials on surrogate outcomes do not end up performing the same way in the real world. As Mann said: “We’ve been fooled before, so we need outcomes data.”

Comparison with current therapies

There are already a range of statins, mostly available generically, that are proven to lower LDL cholesterol so the medical community will expect some evidence on how these new products can compete with what we already have. Mann said: “These drugs will never be mass market drugs like statins because they are too expensive and generic statins are available.” Her argument is that if the outcomes data are favourable, they will be much more widely used than now.

According to Mann, one of the main features of the FDA advisory committee meeting discussion on the approval of the PCSK9 inhibitors was a wariness about the precise patient population who would end up taking these drugs. Some patients do not tolerate statins well, and she said the FDA was “concerned patients would be encouraged to switch from a statin, shown to reduce heart attacks, to these, where they don’t have outcomes data”. She points out what we know about statins, and their safety profile is much more solid than data on PCSK9 inhibitors, where there are still many unknowns. In the United States, insurance companies and pharmacy benefit companies use pre-authorisation processes and usually require a patient to have tried at least two statins and ezetimibe before moving on to a PCSK9 inhibitor.

At the same time, many cardiologists say there is a need for additional therapies for patients with familial hypercholesterolaemia and for those who do not tolerate statins. Mann expressed concern that, in one of the pre-approval studies, there were more strokes in the PCSK9 inhibitor group than the placebo group[19]

.

Too soon for the pedestal

There is enthusiasm on both sides of the Atlantic for a class of drugs that analysts claim could be worth as much as US$150bn a year[20]

, launching these two new drugs into the “blockbuster” category. This is boosted by the medical press, including the prestigious Harvard Medical School, in an article entitled ‘PCSK9 inhibitors: a major advance in cholesterol-lowering drug therapy’, which said PCSK9 inhibitors are superb cholesterol-lowering agents that can lower LDL levels, compared with placebo, by about 60%[21]

.

Part of the confusion of the drug’s benefits may be linked to the way in which they are reported in the media. Both Bloomberg[22]

and Reuters[23]

reported on PCSK9 inhibitors with stories that exaggerated the effectiveness of the drugs, saying they reduced the risk of heart attack and other major cardiovascular problems by more than half, compared with standard treatment alone. The study that was cited by the press was published in the New England Journal of Medicine

[24]

, in which patients randomised to evolocumab had about a 1% risk of cardiovascular events compared with 2.2% in the control group — for a 1.2% absolute risk reduction. Yet it was the more impressive 50% reduction that appeared in headlines. The absolute difference was slightly larger — 1.6% — for patients taking the second drug, alirocumab.

It should be clear later in 2016 whether the drugs actually provide effective and safe treatments for patients with familial hypercholesterolaemia who cannot tolerate statins. The large outcomes studies currently under way should be able to demonstrate if the drugs reduce the risk of cardiovascular events and how safe they are. Fortunately, the studies are large cardiovascular outcomes trials in high risk patients. The ODYSSEY trial[25]

, for example, will randomise alirocumab with 18,000 patients and will continue until a minimum of 1,613 primary endpoint events and a two-year follow up has been achieved. Perhaps by then, cardiologists, clinicians and patients will be able to make much more reasonable and informed opinions about the overall value of these treatments.

Alan Cassels is a drug policy researcher affiliated with the Faculty of Human and Social Development at the University of Victoria, British Columbia, Canada.

References

[1] Phend C. Update: PCSK9 inhibitors hit the market. Medpage Today. 3 January 2016.

[2] Riordan M. PCSK9 inhibitors not cost-effective at current price: ICER review. Medscape. 9 September 2015.

[3] Everett B, Smith R & Hiatt W. Reducing LDL with PCSK9 inhibitors — the clinical benefit of lipid drugs. N Engl J Med 2015;373:1588–1591. doi: 10.1056/NEJMp1508120

[4] Hall SS. Genetics: a gene of rare effect. Nature 2013;496:152–155. doi: 10.1038/496152a

[5] Abifadel M, Varret M, Rabès JP et al. Mutations in PCSK9 cause autosomal dominant hypercholesterolemia. Nat. Genet 2003;34:154–156. doi: 10.1038/ng1161

[6] Abifadel M, Elbitar S & El Khoury P. Living the PCSK9 adventure: from the identification of a new gene in familial hypercholesterolemia towards a potential new class of anticholesterol drugs. Curr Atheroscler Rep 2014;16:439. doi: 10.1007/s11883-014-0439-8

[7] Joseph L & Robinson JG. Proprotein convertase subtilisin/kexin type 9 (PCSK9) inhibition and the future of lipid lowering therapy. Progress in Cardiovascular Diseases 2015;58:19–31. doi: 10.1016/j.pcad.2015.04.004

[8] Brauser D. FDA advisory panel recommends approval of alirocumab, citing value for patients with FH. 9 June 2015.

[9] Navarese EP, Kolodziejczak M, Schulze V et al. Effects of proprotein convertase subtilisin/kexin type 9 antibodies in adults with hypercholesterolemia: a systematic review and meta-analysis. Ann Intern Med 2015;163:40–51. doi: 10.7326/M14-2957

[10] US Food and Drug Administration. FDA approves Praluent to treat certain patients with high cholesterol. 24 July 2015.

[11] Mangan D & Tirrell M. Pricey new cholesterol Rx covered by big drug plan, but… 6 October 2015.

[12] Express Scripts. The country’s first PCSK9 inhibitor. 29 July 2015.

[13] National Institute of Health and Care Excellence. NICE issues draft guidance on evolocumab for lipid disorder. 18 November 2015.

[14] Tice JA, Kazi DS & Pearson SD. Proprotein convertase subtilisin/kexin type 9 (PCSK9) inhibitors for treatment of high cholesterol levels — effectiveness and value. JAMA Intern Med 2016;176:107–108. doi: 10.1001/jamainternmed.2015.7248

[15] Taylor N. European Regulatory Roundup: UK’s NICE takes sides in PCSK9 market. 11 February 2016.

[16] Staton T. Big pharma’s new PCSK9, heart failure meds stuck in the slow lane. What gives. FiercePharmaMarketing. 9 February 2016.

[17] Ishmael H. Regeneron Pharmaceuticals: why investor response to Praluent sales was uncalled for. Bidness Etc. 5 November 2015.

[18] Schoonveld E. The price of global health, 2nd ed. New York: Gower Publishing; 2015, p40.

[19] Institute for Clinical and Economic Review. PCSK9 inhibitors for treatment of high cholesterol: effectiveness, value and value-based price benchmarks, final report. Table 7, p24. 24 November 2015.

[20] Staton T. Say what? CVS Health execs figure PCSK9 meds to cost up to $150bn. Fierce Pharma. 17 February 2015.

[21] Curfman G. PCSK9 inhibitors: a major advance in cholesterol-lowering drug therapy. Harvard Health Publications. 15 March 2015.

[22] Cortez MF & Chen C. These new drugs could cut heart risks in half. Bloomberg Business. 15 March 2015.

[23] Beasley D. Experimental cholesterol drugs cut heart risk, but questions remain. Reuters. 15 March 2015.

[24] Sabatine MS, Giugliano RP & Wiviott SD. Efficacy and safety of evolocumab in reducing lipids and cardiovascular events. N Engl J Med 2015;372:16. doi: 10.1056/NEJMoa1500858

[25] Schwartz GG, Bessac L, Berdan LG et al. Effect of alirocumab, a monoclonal antibody to PCSK9, on long-term cardiovascular outcomes following acute coronary syndromes: rationale and design of the ODYSSEY Outcomes trial. American Heart Journal 2014;168:682–689. doi: 10.1016/j.ahj.2014.07.028