McLean

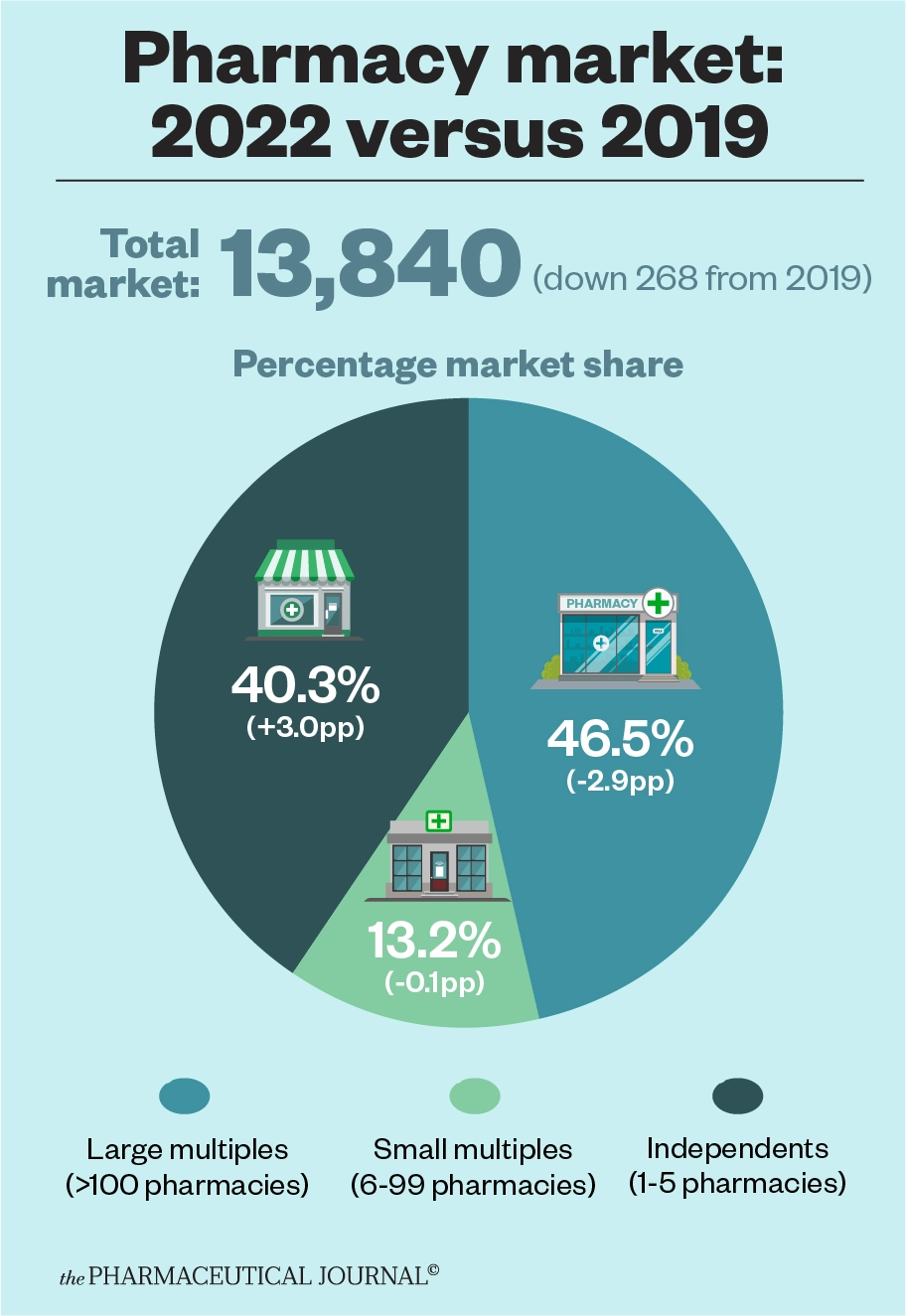

Chronic underfunding combined with the additional pressures of the COVID-19 pandemic has resulted in a net loss of 268 pharmacies across Great Britain since our most recent analysis in January 2019 (see Figure 1). Although large multiples have continued to divest branches, the independent pharmacy sector is expanding and now makes up around 40% of the market.

PP = percentage points

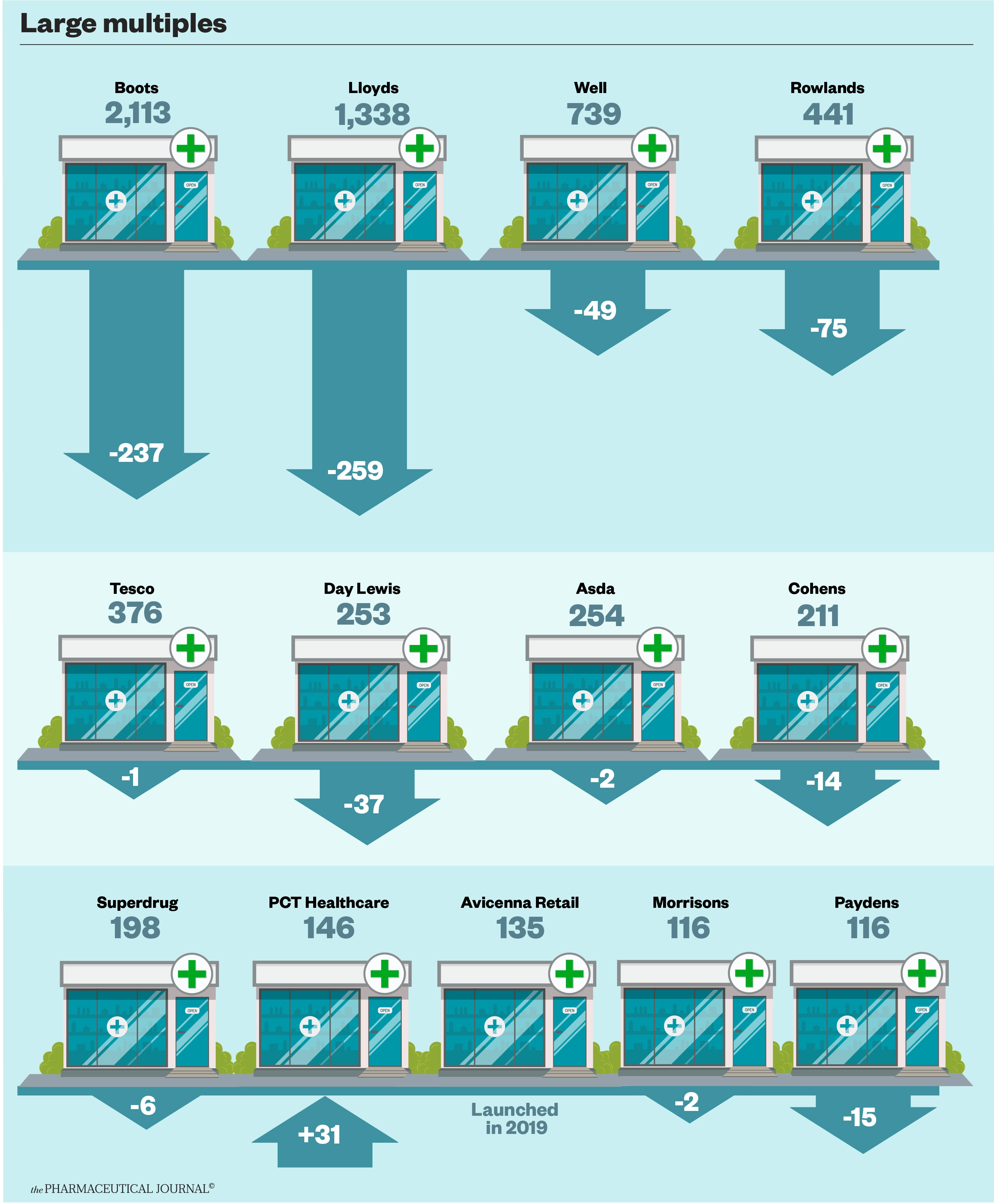

Large multiples

There has been a net fall of 531 large multiple pharmacies over the past three years, with nearly all companies closing branches, including the largest two chains (see Box 1).

However, there are signs that the rate of closures is slowing down, with data analysed by The Pharmaceutical Journal showing net pharmacy closures in 2021 were half those in 2020.

There is even a newcomer to the large multiple category — Avicenna Retail Ltd — which now has 139 pharmacies (latest acquisitions not reflected in our data, which is by owner; see Figure 2). The multiple was born from former pharmacy chain Juno Health in 2019. Since then, it has acquired 57 pharmacies from Dudley Taylor and 35 from Sheppards, alongside several other independent community pharmacies, and plans to continue growing. Avicenna also owns the Avicenna Buying Group, which supports more than 1,000 independent pharmacies.

Box 1: Spotlight on Boots and LloydsPharmacy

Boots, the largest multiple, announced the closure of 200 “loss making stores” in 2019, as well as the closure of pharmacy provision within 22 Boots retail stores in 2021. However, the digital side of the business is expanding, with the latest financial figures showing digital sales in the second quarter of fiscal 2022 were up 60% compared with pre-COVID-19 levels in the second quarter of fiscal 2020. The multiple also expanded its online doctor service in June 2021 in response to changes in consumer habits following the pandemic. Changes are also afoot in the ownership of Boots UK, with parent company Walgreens Boots Alliance putting it up for sale at the beginning of 2022, following a strategic review and a renewed focus on the United States and healthcare.

The second largest chain LloydsPharmacy has also experienced a change of ownership, with asset management group Aurelius buying its parent company McKesson in April 2022. LloydsPharmacy has continued its programme of divestment over the past three years and has seen the largest net fall in pharmacies among the multiples, at 259 branches. However, like Boots, the online business is growing, with LloydsPharmacy reporting a more than eightfold increase in revenue — at 731% — from its online pharmacy LloydsDirect during the 2020/2021 financial year. LloydsDirect is now second only to Pharmacy2U in terms of electronic prescription service nominations, with 586,775 nominations in March 2022, up from 131,740 in March 2020.

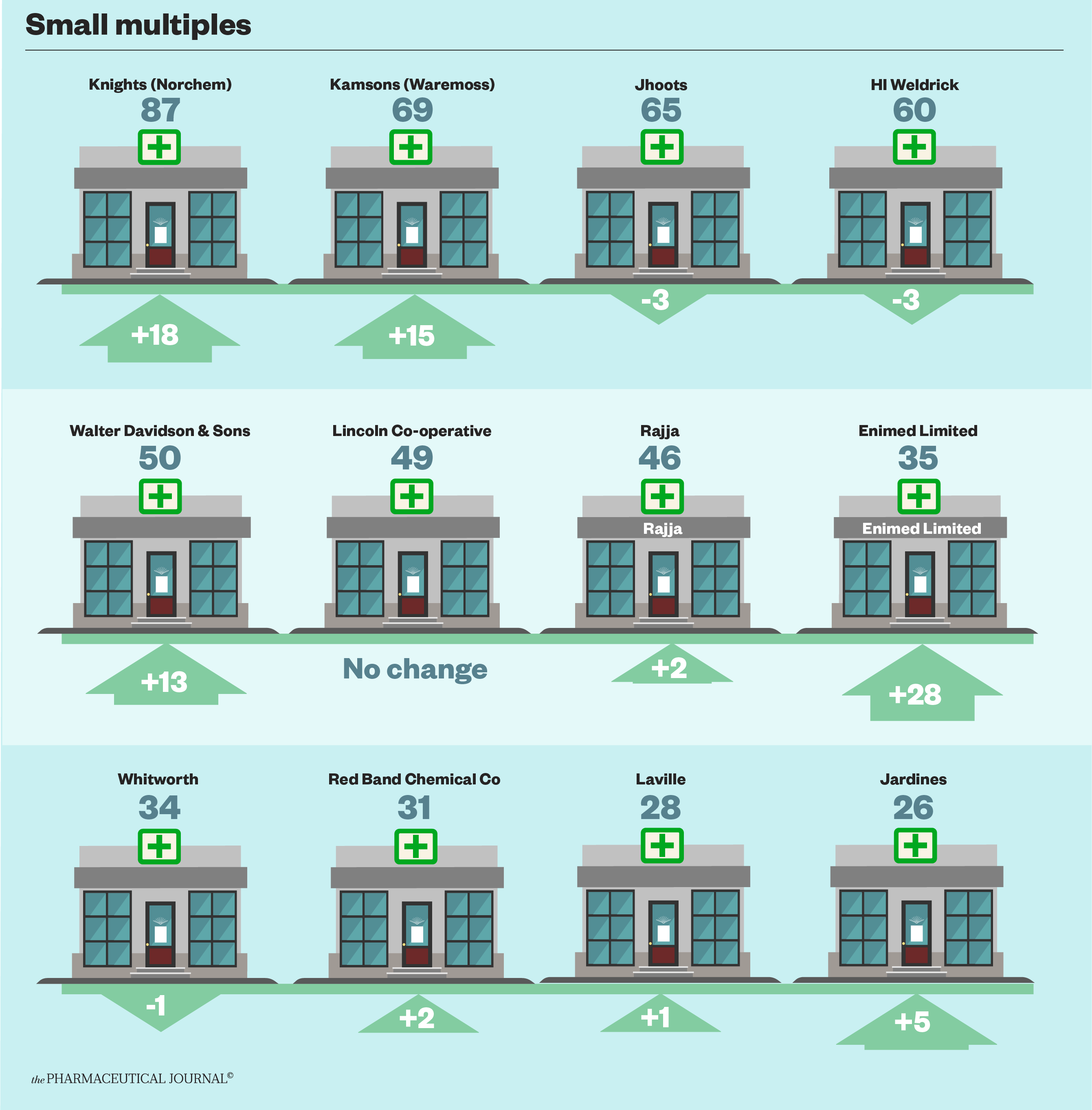

Small multiples

There has been a net fall of 44 small multiple pharmacies since 2019, in contrast to the net increase seen in the previous three years. However, some groups have continued to expand (see Box 2).

Enimed, an independent group with pharmacies mainly across the south-east of England, saw the biggest net increase in number of pharmacies among the 12 largest chains (by owner; see Figure 3), acquiring all 19 of the Manichem Group’s branches across England and Wales in 2019.

Box 2: Spotlight on Knights

Knights is a family business that was founded in 1984 and now has 98 pharmacies across England and Wales (latest acquisitions not reflected in our data), making it the largest of the small multiples.

In 2015, Knights acquired Norchem Healthcare and, in 2017, added pharmacies in North Wales and the Wirral to its network through acquisition of Vittoria Healthcare.

In 2021, Knights acquired Pearn’s Pharmacies, which had 20 pharmacies in South Wales. The business has continued to grow and, in 2022, Knights bought Cecil Jones, an independent pharmacy business with 4 pharmacies across South Wales.

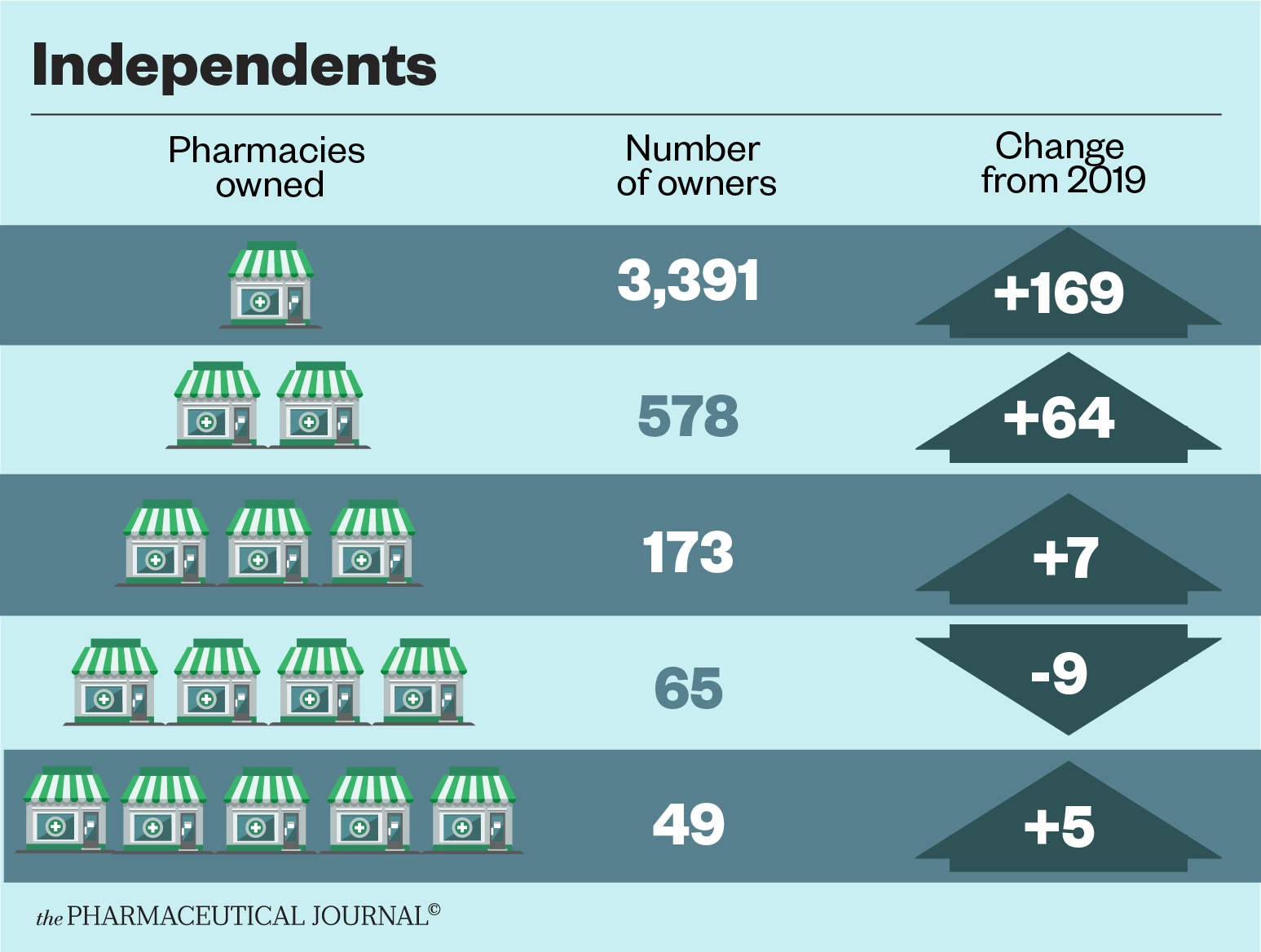

Independents

The number of independents entering the market has boomed over the past three years, with a net increase of 307 independent pharmacies and 236 owners (see Figure 4). This contrasts with a small contraction in the independent sector between 2016 and 2019.

Most independent proprietors (79.7%) own a single pharmacy, with many entering the market for the first time (see Box 3).

Box 3: Spotlight on Brockhurst Pharmacy

Nishaan Amin, a young pharmacist from Portsmouth, bought his first pharmacy — Brockhurst Pharmacy in Gosport — from an independent in October 2020. He has recently acquired a second pharmacy close by, this time from a small chain called Hobbs Pharmacy, which had purchased the branch from LloydsPharmacy in 2019.

And Amin doesn’t intend to stop there; he says he would welcome the opportunity to take over from any multiples in the area that are looking to dispose of their NHS contracts.

Amin believes that independents are thriving because they offer a more personal service and are willing to go the extra mile to make sure customers get the medicines they need.

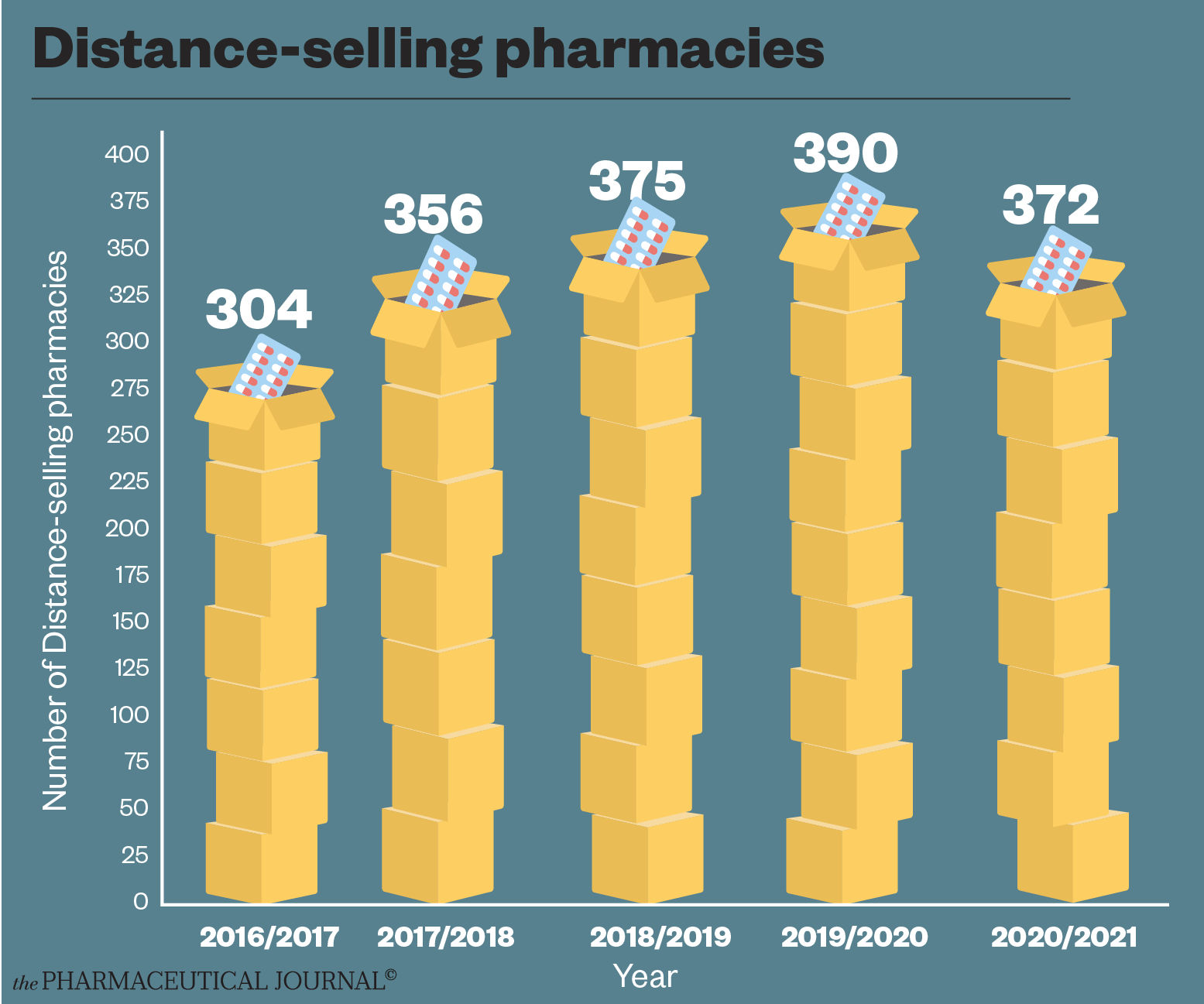

Distance-selling pharmacies

Although the rise in the number of distance-selling pharmacies (DSPs) appears to be slowing in England (see Figure 5) – DSPs are not permitted in Scotland and Wales – the number of patients nominating DSPs through the electronic prescription service continues to grow, nearly doubling from 999,498 to 1,950,497 between March 2020 and March 2022. Pharmacy 2U received the highest number of nominations at 665,486 in March 2022, up from 421,097 in March 2020.

The number of items dispensed by DSPs has quadrupled in the past five years, going from 13 million items in 2016 to 53 million items in 2021, a 301% increase. This compares with only a 2.3% increase in the number of items dispensed by all community pharmacy contractors in England over the same period.

Sources: General Pharmaceutical Council register of premises January 2019 and March 2022; NHS Business Services Authority